Personal Capital and Mint are considered as two of the most well-known financial services platforms available. They both offer free services that give their users powerful investment and money management tools. These two services are usually compared as there are overlapping similarities between the two, however, each has a different key function. For example, while Mint is essentially a budgeting application, Personal Capital primarily serves as an investment management platform.

Personal Capital and Mint are apps used for aggregating all the financial information of their users into one place. Both apps can be downloaded and used for free.

While both of these apps do an excellent job of consolidating the financial information of their users into one place, each one of these apps uses a different approach.

Personal Capital

More than 1.5 million people use Personal Capital as a financial platform. They offer a free version and a premium paid version that can handle the direct management of your investments, among others.

Free Version

The free version of Personal Capital enables its users to connect to all of their financial service providers such as mortgage companies, banks, and investment brokers to access their information and pull it over to their Personal Capital dashboard.

From that information, the user can receive a customized analysis of their finances. Then Personal Capital will make recommendations based on what it observes. Some of the areas that are analyzed by Personal Capital include:

- Net Worth – Personal Capital automatically calculates your net worth. Users can see a complete picture of their net worth every time they log in to their dashboard.

- Hidden Fees – Over time, hidden brokerage fees add up and can delay your retirement. The Fee Analyzer of Personal Capital gives its users complete transparency into the fees that they are paying to their broker, helping them make informed decisions regarding their investments.

- Investment Checkup – This is a tool used by Personal Capital to analyze the investment portfolio of their users, helping them look for ways to make improvements in order to help them meet their investment goals.

- Keeping You on Track – Users of Personal Capital can see if they are on track for retirement based on their information. They can run various scenarios such as how college, having an illness, or having a baby can affect their long-term plan.

When you sign up with Personal Capital, you will be assigned to a personal financial advisor with whom you can make an appointment to call to review your investments.

Personal Capital does not only analyze the finances of its users but also empowers them to get more personalized insights into their finances. The powerful tools used by Personal Capital help users manage their money on an ongoing basis so they can maintain complete control over their money.

These powerful tools include:

- Cash Flow Tool – The users of Personal Capital receive insights into their weekly, monthly, and yearly spending habits. The users can find out where their money goes so they can make adjustments as needed.

- Asset Allocation – The users of Personal Capital can check all their investments, accounts, etc. to make sure that they are well diversified and make adjustments as needed.

- Budgeting – The users of Personal Capital can set a monthly spending target and automatically track it to see where they stand on any given day.

Paid Version

Personal Capital also offers a paid money management service. They make use of personalized tools and registered financial advisors to help users manage their finances and investments better. Here are some of the available benefits of the paid version:

- Personalized Advice – The users of Personal Capital will have personal access to registered financial advisors via video conference, phone, chat, and email.

- Holistic Financial Planning – Personal Capital takes all of the finances of a user into account when offering you advice.

- Optimize Risk vs. Return – Personal Capital makes use of a Modern Portfolio Theory to weigh the investments of a user for maximal returns that have minimal risk.

- They Abide by the Fiduciary Standard – This means that Personal Capital is legally required to act in the best interest of their users at all times, not theirs.

- Avoid Hidden Fees – Using the all-in-one management fee, they have much lower fees compared to the traditional brokers.

- Tax Optimization – Personal Capital takes taxes into account when they give investment advice to their users. This tax loss harvesting enables users to receive higher yields for their retirement investments.

After signing up with Personal Capital Wealth Management, getting started is a simple process. You will be required to link your accounts, schedule discussions with an advisor where you can discuss your financial goals, and create Your Plan where your advisor will help you build a financial plan that will be suitable for your needs.

Fees

A flat fee is charged by Personal Capital Wealth Management. The fee will depend on your investable assets. Below is a chart that shows a quick breakdown of the fees:

| Investable Assets | Features | |

| Investment Service | Up to $200k | Access to free online tools plus:

l Financial Advisory Team l Dynamic Tactical Weighting l Tax Efficient ETF Portfolio l Cash Flow and Spending Insights l 401k Advice l 24/7 call access including weekends and after-hours |

| Wealth Management | $200k – $ 1M | Everything in Investment Service plus:

l Two dedicated Financial Advisors l Full Financial and Retirement Plan l Customizable Individual Stocks & ETFs l Financial Decisions Support (including insurance, Home Financing, Stock Options, and Compensation l Tax Loss Harvesting & Tax Location l College Savings & 529 Planning |

| Private Client | Over $1M | Everything in Wealth Management plus:

l Priority Access to CFP® Advisors, Investment Committee & Support l Family Tiered Billing l Investment Portfolio Mix of ETFs, Individual Stocks and Individual Bonds (in certain situations) l Estate, Tax and Legacy Portfolio Construction l Private Banking Services l Private Equity and Hedge Fund Review l Donor Advised Funds l Estate Attorney & CPA Collaboration l Deferred Compensation Strategy

|

How to Access Personal Capital

You can have access to Personal Capital from your desktop computer, laptop, or use the handy app available for your iPhone, iPad, Apple Watch, or Android Phone. The app is free of charge and is just as great as the desktop version.

Mint

Mint is also a great platform that is used to combine all your financial data into one place. It is completely free to use and has various features that make it stand out from Personal Capital. Users can easily link everything from checking and savings accounts, mortgages, investment accounts, loans, credit cards, and other financial accounts to their Mint account.

Some of the most prominent features of Mint include:

Mint Bills

User can link up all their bills to the Mint dashboard, including utility bills, credit cards, car payments, etc. Users can schedule their payments and set them up to be deducted from their bank account or have them paid with a credit card if they wish to.

With Mint Bills, users can:

- See all their bills in one simple, organized place

- Pay bills manually or automatically

- Avoid late fees

- Quickly deliver payments

- Save tons of time paying bills

- Receive alerts for upcoming bills due

Mint Alerts

Mint does not only notify users about their upcoming due dates but also sign them up for Mint Alerts that will help them with so much more.

With Mint Alerts, users can set up all types of alerts such as:

- When they incur a late fee

- When interest rates on their loans change

- If they are about to exceed their budget

- Low balance in their bank accounts

- When their credit score changes

- If a large purchase is made

- When unusual spending is detected

- When they meet a goal they have set

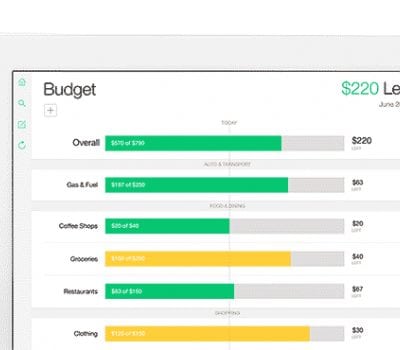

Mint Budgeting

The budgeting feature of Mint is probably one of the strongest features that it has. Once users link their bills and accounts, Mint sorts all of their transactions into the proper categories automatically in real time.

Then the users can customize their budget as they like. They can set up categories and sub-categories for any expenses that they incur on a regular basis and set limits for each type of expense.

Mint will keep track of how their users are doing throughout the month and alerts its users if they are about to exceed their budget in any given category.

Users will be able to analyze their budget, then look for ways to adjust their expenses and change their spending habits as time goes by.

Custom Tips

Mint also offers its users custom tips to help them save money and achieve their financial goals. At the bottom of the Mint dashboard of the users, they will see a section labelled Ways to Save where they will see how much they can save on various items such as credit cards, bank accounts, auto insurance, brokerage fees, and other financial services.

The custom tips are just a showcase for the advertising partners of Mint. But that is actually fine since they offer the users a lot of information in one place where they will be able to compare services and see how much money they can save if they switch to one of their partners.

Credit Scores

Mint also monitors the credit score of their users. The credit scores of users are updated daily, and they are notified any time new information is given by their creditors that may affect their score.

Users will also be able to see things that may affect their credit score, and receive tips on how to improve their scores if needed. Knowing your credit score is free of charge with Mint.

Create Goals in Mint

Mint allows their users to create customized goals for their finances. Users can create goals for almost anything, from saving for a house or for college, to creating an emergency fund, and paying off credit card bills. Users can create a goal by clicking on the Goals tab in their dashboard, then selecting from the preset goals that are featured by Mint, or creating a custom goal of their own.

Mint Investments

The users will be able to get an overall picture on how their investments are doing, and receive some advice on how they can improve they investment strategies if needed.

With all the investment information of a user kept in one place, the user can keep track of:

- Performance – how their investments appreciate over time

- Value – how much all their investments are worth.

- Allocation – helps them determine if their assets are well diversified.

- Comparisons – compare their investment performance against the Dow Jones Average, the NASDAQ, and the S&P 500

Brokerages also tend to have a lot of hidden charges, and Mint can help users discover them. Mint analyzes the fees that users are paying and help them look for ways to pay less.

Unlike Personal Capital, Mint does not have an option for professional investment management. Mint is best suitable for individuals who are comfortable with managing their own investments.

Transactions

Another good feature offered by Mint is that users get to have an overview of all their financial transactions in one place. This is especially useful if a user has multiple bank accounts. A user will be able to easily check the total amount of cash that he or she has across all accounts and how it is being used.

How to Access Mint

The mobile app of Mint offers all the functionality that is in the desktop version. User can check all their accounts from their smartphone and tablet and always be on top of their financial game. The Mint mobile app is free.

Personal Capital vs. Mint : Which is the Better Option?

Personal Capital and Mint are very similar in a lot of ways as they both:

- Aggregate all the financial information of their users into one place

- Give users the ability to analyze their investments

- Allow users to set goals for their money

- Help users keep up with their financial transactions, tagging and editing them as necessary

- Allow users to keep up with their net worth, which is updated daily

The Comparison of Personal Capital vs. Mint

Let us break down the comparison into these categories: Bill Alerts and Bill Pay, Budgeting, Customer Service, Synchronization, Security, Investment Analysis, Retirement Planning, and Mobile Access.

| Category | Comparison | Winner |

| 1. Bill Alerts and Bill Pay | Both Mint and Personal Capital have a feature that alert users on upcoming bills. However, Mint gives much more bill alerts and reports bills that are falling due accurately. On the other hand, Personal Capital, misses bills and users cannot use this functionality to depend on bills to pay. Mint will also inform you via email of a pending bill. | MINT |

| 2. Budgeting | Unlike Personal Capital, Mint is a budgeting platform, not an investment platform.

Mint has a full-featured budgeting functionality that allows users to have access from their desktop and mobile.

Personal Capital, on the other hand, does not offer a full-function budgeting tool. Users can monitor their cash flow but they cannot set specific spending targets. |

MINT |

| 3. Customer Service | Mint has no customer service. Personal Capital is very responsive. It has been reported by Mint users that if you run into some problems, support is pretty much useless. | PERSONAL CAPITAL |

| 4. Synchronization | Mint makes use of the synchronization service of Intuit.

Personal Capital uses Yodlee to sync up financial services and has much fewer reported issues regarding synchronization. |

PERSONAL CAPITAL |

| 5. Security | Mint offers two-factor authentication. Personal Capital has a “poor man’s version” that requires users to register their computer before using. Users will not be able to log in unless the computer is registered via a PIN that is sent via email or a phone call.

Both services are read-only, users cannot perform transactions (such as transfer cash out of their bank accounts) via the service, and the information they download does not include account numbers and other identifiable data.

Both apps allow for fingerprint login on iOS devices that support it. |

MINT |

| 6. Investment Analysis | Mint doesn’t offer tools to manage investments.

Personal Capital will give users access to retirement forecasting, projected portfolio values, personal evaluation to see if you’re on track, and possible variables that may affect your retirement goals. |

PERSONAL CAPITAL |

| 7. Retirement Planning | Mint does not have a retirement planning overview, projected portfolio value or any other features that are related to investment.

With the latest Retirement Planning feature of Personal Capital, it will help users determine how much they need to save for retirement within a few seconds. This feature is absolutely free. |

PERSONAL CAPITAL |

| 8. Mobile App Access | Both have apps that are supported by Google Android and Apple iOS. | TIE |

Conclusion

Personal Capital is considered as one of the best investment apps available. Though it is not as good in budgeting and bills payment as Mint. Personal Capital is reliable, has excellent customer service, and retirement planning and investing features.

Personal Capital and Mint are not supposed to be competing platforms for personal finance as Personal Capital is an investment platform with limited billing and budgeting capacity while Mint is a budgeting platform that has little investment support.

Whether you need advice and powerful tools to manage your investments (Personal Capital) or need to do a better job at managing your daily finances (Mint), we believe that each of these platforms perform their jobs well.

In fact, it is a good idea to use both. You can use Mint as your budgeting tool and manage all of your investments through Personal Capital. Since both of these platforms are read-only and cloud-based services, nothing prevents you from simultaneously using both.