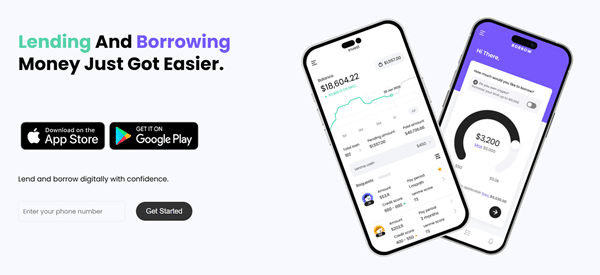

Lenme is a simplified borrowing and investing app that's available in the United States. And it's a legit way to get quick money if you're in a pinch. And for investors, it offers a unique opportunity to earn passive income through peer-to-peer lending.

I've spent time researching and testing out Lenme to figure out everything this app has to offer. And overall, I think it's a strong contender in the world of cash advance apps, especially if you're borrowing a small amount. As for investors, it's certainly on the riskier side, but could be an interesting way to diversify your investments.

This Lenme review is covering how this app works, its main features, fees, and everything you need to know.

Want some other fun ways to earn? Checkout:

- Scrambly: Earn cash by playing fun mobile games and downloading apps!

- Branded Surveys: Share your opinion to earn gift cards and PayPal money!

My Key Takeaways:

- Lenme is a lending and investing app in the United States for Android and iOS

- It offers cash advances up to $200 and personal loans up to $5,000

- Lenme also has crypto-backed loans

- Investors can also fund loans through Lenme to generate passive income

- You have to be 18 or older to use the app

- Lenme has generally positive reviews on the borrowing side and mixed reviews on the investing side

What Is Lenme?

Lenme is a peer-to-peer lending app that connects borrowers with investors. And you can download it for Android and iOS and sign up if you're 18 or older, live in the United States, and have a valid SSN.

What makes Lenme unique versus apps like EarnIn or Albert is that the platform is peer-to-peer based. So instead of borrowing money from a bank or central company, Lenme has a network of investors who help fund advances and loans people need.

This dual-sided platform is interesting. On the borrowing side, Lenme could be useful if you need money for rent, bills, or other expenses. After all, you can advance up to $200 and borrow up to $5,000 through Lenme.

And on the investing side, Lenme is an interesting passive income app where you can fund loans and potentially get a nice return on your capital.

The entire idea behind Lenme is to make borrowing and investing more flexible and accessible, especially for people who might not qualify for traditional credit products.

Is Lenme Legit?

Lenme has been around since 2018 and has since grown to over 1 million users and originated over $18 million in loans. It's a legit company that's highly rated too, with a 4.3 star rating on the Google Play Store and 4.4 star rating on the Apple App Store.

Lenme's peer-to-peer network is what makes it unique. You don't have to jump through as many hoops as you would with a traditional bank or lender. And your credit score doesn't matter as a borrower, which is very unique.

That said, just because it’s legit doesn’t mean it’s the best option for everyone. Borrowers should be cautious about high fees and interest rates, and investors should understand the risk of lending to individuals with varying credit profiles since borrowers can default.

How Does Lenme Work?

The Lenme app has three core features: cash advances, personal loans, and investing. Here's how each of them works!

1. Cash Advances

Lenme offers cash advances to borrowers between $50 and $200. The app says these advances are instant and that your credit score doesn't matter either. However, an investor in Lenme's network still has to see and accept your advance offer, which can take time.

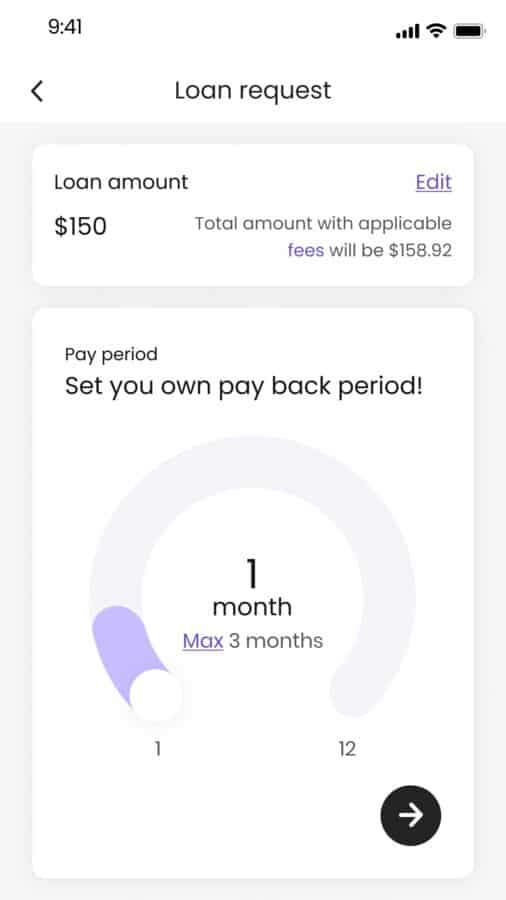

Typically, advances of $200 that offer a 1-month payback period get accepted pretty quickly. If you set a longer payback period, the chances your advance gets funded is much lower, so keep this in mind. Loan durations have a minimum of 1 month and maximum of 12 months on Lenme.

I like that Lenme clearly shows the fee breakdown when you request a loan. For example, you can see the screenshot above, where a $150 loan request with a 1-month payback period costs $158.92 in total.

Paying $8.92 in fees for $150 is a 5.94% fee. Honestly, this isn't too bad compared to what most credit cards charge. And it's way lower than turning to a payday loan.

A $200 advance limit is a bit on the lower side, however. This is the same as what Klover offers but is lower than platforms like Current offer.

Extra Reading 👉 How To Get $500 Dollars By Tomorrow.

2. Borrow Money

Alongside advances, you can also take out personal loans on Lenme of up to $5,000.

Once again, you create a loan request through the app, select how much you want to borrow, and then set your repayment terms. Lenme investors can then decide to fund the loan or not.

This setup makes it easier for people with limited credit history to find funding. It can also be super useful if you're a gig economy worker and don't have regular employment. But again, there's no guarantee your request ever gets funded.

3. Lenme Investing

Lenme investors can fund advance or loan requests and then earn interest from borrowers.

According to Lenme, it provides investors with “detailed data to help you make smarter investment decisions, including credit reports, loan history, and aggregated income and expenses from the last 90 days of the borrower’s primary bank account.”

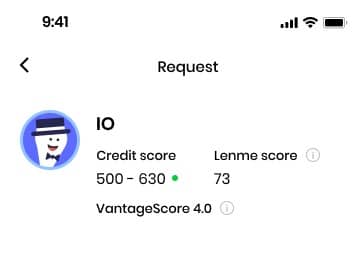

Lenme also provides some other data to help. For example, borrower requests/cards have a green, orange, or red dot to indicate the risk level. Borrowers also have a “Lenme Score” which outlines information like their credit score, VantageScore, and if they can really afford the loan they're requesting.

Ultimately, youchoose which loan requests to fund and set your own risk tolerance. However, there’s no guarantee borrowers pay you back, so defaults are a real risk. And many Lenme reviews I've read explain how some loans get repaid but many go into collections.

Overall, other income-generating assets are much lower risk than peer-to-peer lending. But this could be an exciting way to diversify your investments and potentially earn on autopilot as a lender.

Lenme Requirements

To use Lenme, you must be at least 18, have a valid ID, and have a valid Social Security Number. This app is only available in the United States. Additionally, you need to link a checking account to Lenme.

Lenme says that everyone is eligible to request a loan on the platform, regardless of credit score. That said, factors like your credit score, income, and activity on the platform contribute to your overall Lenme Score and risk profile. If you're a high-risk user, expect higher fees and a lower chance your advances and loans get funded.

Extra Reading – How To Make $100 A Day With Your Phone.

Lenme Fees & Pricing

For borrowers, Lenme charges a minimum of $3 or 1% of the loan amount you request regardless of the interest rate or payment period. Your interest rate on the loan then varies based on the amount, repayment period, and factors like your credit score and risk level.

Lenme also charges monthly plans of $1.99 to $19.99 per month depending on the features you use. This is because Lenme has a bunch of other features, like a Balance Guard Feature which prevents overdraft fees. However, the core app should charge $1.99 per month to request advances and loans.

Overall, Lenme can be much more affordable than traditional lending options. But it can also be more expensive based on your financial history, so always do the math and see if it makes sense to use.

Lenme also charges investors a monthly subscription fee “based on the total amount of loans they fund each month.” The platform says it charges these fees to cover costs involved in verifying borrowers and reducing risk. But I honestly don't think investors should have any mandatory fees for using Lenme, so this is a negative in my book.

Lenme investors can also pay additional monthly fees for more predictive tools that help them determine risk.

Pros & Cons

Pros:

- Lenme is very easy to use

- Helps people with poor credit access funds

- Investors can potentially earn passive income

- The Lenme network has over 1 million members

- Fees can be lower than traditional loans

Cons:

- The fee structure is a bit confusing in terms of monthly subscriptions

- There's no guarantee your advances or loans get funded

- Investors can lose money

- Lenme is only available in the United States

What Are Some Good Apps Like Lenme You Can Use?

I think Lenme is a nice addition to the world of advancing apps. However, it's far from your only option. And many alternatives don't rely on peer-to-peer funding, which can make the process faster if you have decent credit.

Here are some of my favorite apps like Lenme you can also consider:

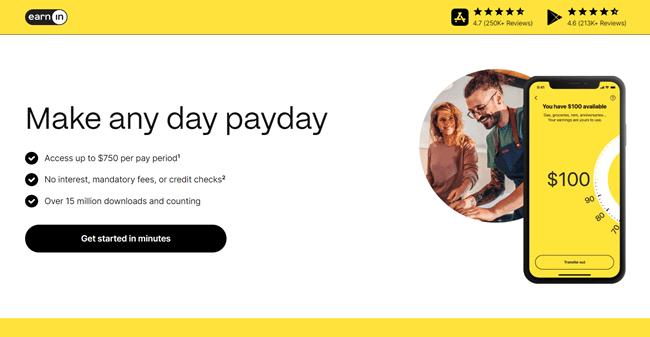

EarnIn is my number on recommendation. It lets you advance up to $150 per day for a total of $750 within a given pay period. And it doesn't charge mandatory fees. However, the downside is that most people get a very small advance limit when starting out.

Extra Reading – How To Make $5,00 Fast.

Final Thoughts – Is Lenme Worth It?

If you're looking for a flexible borrowing solution that doesn't rely on your credit, then Lenme is worth checking out. It can also be much cheaper than other borrowing solutions like a credit card or payday lender. And the app has a large network of peer-to-peer lenders. However, there's no guarantee your requests get funded.

As for investors, I think Lenme is higher risk. There's pretty mixed reviews on social media and various forums, and defaults are a real concern. You can dabble in peer-to-peer lending if you're interested, but understand that there's no guarantees you turn a profit.

Hopefully, my Lenme review helps you decide if this platform is right for you or not!

Want other useful ways to make money? Checkout:

Lenme Review

Name: Lenme

Description: Lenme is a peer-to-peer network that lets people borrow money and investors fund loans.

Operating System: Android, iOS

Application Category: Cash Advance Apps

Author: Tom Blake

-

Borrowing Limits

-

Fees

-

Ease-Of-Use

-

Potential Returns