According to a recent survey from Bankrate, 57% of Americans can't afford a $1,000 emergency right now.

The fact is saving money and building up a cushion of cash isn't easy for everyone. And with many goods getting more expensive, it can really feel like your wallet is being squeezed.

That's why in this post, I'm covering 10+ of my favorite ways to save more money each month.

I've been testing out different money-making and money-saving tips ever since my time in college. And with a few of these tips, you can keep more of your hard-earned money in your bank account.

Want a fun way to earn extra rewards? Checkout:

- Freecash: Get paid to play fun mobile games and to download apps!

- Branded Surveys: Share your opinion to get gift cards and cash!

How To Save More Money Each Month

1. Create A Budget

In my experience, creating a monthly budget is the foundational element to saving more money each month. After all, if you don't know where your money is going, how can you possibly know how to save it?

You don't need to complicate things here either. In fact, there are so many amazing budgeting apps out there that help you track your spending.

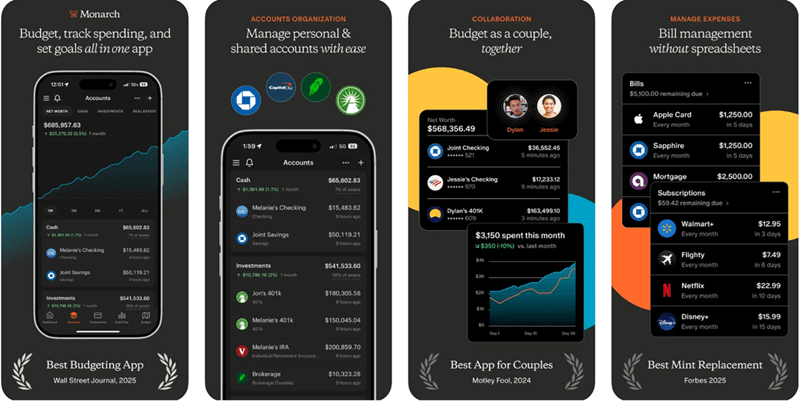

For example, you can use apps like Monarch to easily track your spending and bills. It also helps you set savings goals and manage your money like a pro!

Monarch was even rated as the top budgeting app by the Wall Street Journal. And I love that it's so easy to use and can create a budget for you automatically.

Monarch also has an awesome free trial for you to give it a go. And you can even get 50% off its annual plan afterwards, which is definitely worth it if Monarch helps you reach your financial goals.

2. Ditch Bank Fees & Earn Cash Back

Want to save money easily? Then ditch your bank fees and earn cash back when you shop instead.

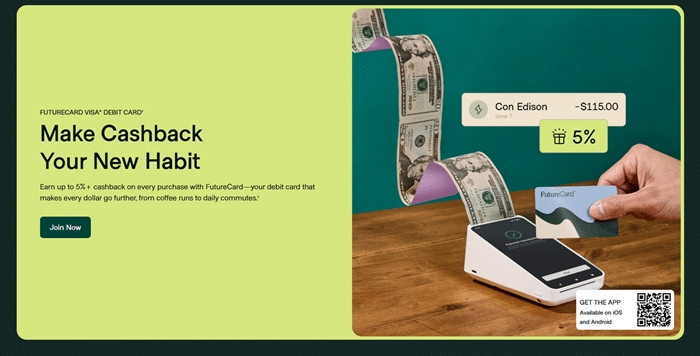

With the FutureCard Visa Debit card, you earn an impressive 5% cash back at 50,000+ retailers and 1% back everywhere else. PLUS, you don't pay any minimum monthly fees at all!

This is an easy way to get paid on autopilot for shopping like you normally do. And I love that this is a no-fee debit card, so it doesn't impact your credit score either.

Start earning with FutureCard!

3. Boost Your Credit Score For Free

A lot of people don't realize this, but boosting your credit score can actually help you save a ton of money.

A higher score can reduce certain insurance premiums to save more money. You can also secure lower interest rates if you're borrowing money. And even rent and utility deposits can become cheaper.

This is why we're big fans of using a company like Self at The Budget Diet.

Self has numerous tools to help people boost their credit score easily. This includes a free rent and bills reporting tool that reports your on-time payments to all three major credit bureaus. And Self also has a nifty credit builder plan you can use to boost your score faster.

This is one of the most popular solutions out there. And it's also perfect if you currently have zero credit history or a low score and want an easy way to begin improving.

4. Save Money When Online Shopping

Shopping online can be a great way to snag deals and save time. You also cut back on gas by not heading to the store.

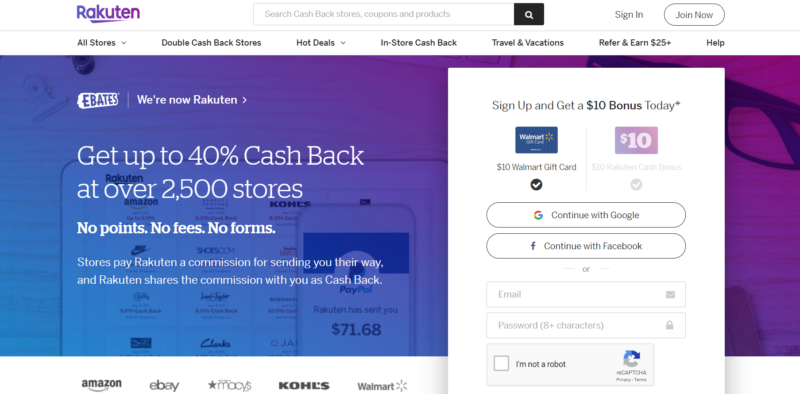

However, online shopping can still tempt you to overspend. And if you don't use tools like Rakuten, you might still miss out on potential savings.

This shopping browser extension automatically lets you earn cash back when you shop at thousands of stores. And it also helps you find coupons and other deals to maximize your savings.

Rakuten is 100% free to use, which is why we love it at The Budget Diet. And new members also get a nice sign up bonus of $50 once they sign up and complete an eligible shopping offer, which is pretty sweet. Plus, Rakuten pays you right to your PayPal account!

You can check out other shopping tools as well. For example, both Coupert and Kudos can help you earn cash back when you shop online too. But for upfront savings, we suggest trying out Rakuten, especially with its bonus.

5. Use Cashback Reward Apps

I've been using reward apps ever since college to earn cash back and free gift cards when shopping. And this is a very simple way to save a bit more money each month, especially if you do most of your household's shopping.

Some of the top apps that pay you for shopping include:

- Snaplii: A cool app that lets you earn cash back when you shop with gift cards.

- Upside: This gas rewards app pays you up to $0.25 per gallon.

- Fetch: A popular grocery rewards app with gift card rewards.

- Ibotta: One of the most popular U.S. cashback apps.

- Pogo: A passive income app that pays you whenever you shop.

- Bridge: Another app that pays you with passive income for every purchase.

- P&G Good Everyday: Save money and get exclusive deals on P&G brands.

I also made a video that covers even more reward apps if you're curious.

You still need to stick to a budget when you shop. But in my experience, earning $10 to $25 per month with these apps is quite realistic, which is over $100 per year on the low end and $300 on the higher end!

Save money on gas with Upside!

6. Get Your Paycheck Earlier To Cover Bills

Life gets expensive sometimes. And there's always bills to pay like groceries, gas, or rent tomorrow.

However, you don't have to wait two weeks to get your paycheck. Instead, you can use a leading cash advance app like EarnIn or Dave to borrow money against an upcoming paycheck.

With EarnIn, you can borrow $100 per day, up to $750, in a given pay period. And you don't pay any interest either. In fact, there's no mandatory fee whatsoever if you wait a couple of days for your cash advance, and there's just a small Lightening Speed fee if you need the cash immediately.

All you have to do to get started is download EarnIn and connect your bank account to the app. EarnIn then analyzes your previous paycheck history to determine how much you can borrow.

Not everyone gets approved for the $750 limit. But you build your limit overtime with consistent paychecks and on-time payments. And solutions like EarnIn are ultimately way more affordable than wasting money on loans.

Extra Reading: Ways To Get $500 By Tomorrow.

7. Cancel Some Subscriptions

If it's been a while since you've reviewed some of your monthly recurring charges, it could be time to cancel some of the unused ones.

Some of the sneakiest subscriptions people often forget about include:

- Ecommerce subscriptions like Amazon Prime

- Streaming subscriptions like Netflix or Hulu

- Online app or website subscriptions

- Memberships

- Subscription boxes

If you don't use a service, ditch it and save more money. The only exception I'd suggest would be for fitness memberships, like a gym membership. If you don't use your gym membership, get more active and make sure you're getting your money's worth.

Pro Tip: You can use Rocket Money to find and cancel unused subscriptions and to track your monthly spending to avoid overspending!

8. Build An Emergency Fund

An emergency fund is a cash cushion you can build to cover emergencies when they pop up.

This could mean covering car repairs, a water heater breaking, or some other sudden expense. And having this fund is crucial if you want to avoid using your credit card or taking out a loan.

Putting a bit of money aside each month into a separate savings account is a good way to build this fund. Plus, you can earn passive income with this money as it sits on the sidelines.

For example, high-yield savings accounts like Current pay a 4% bonus on up to $6,000. It also doesn't charge any account fees which is pretty awesome.

You can look for other savings accounts at your bank or in your country. And again, Raisin is a useful online marketplace you can use to find the highest rates for dozens of banks and credit unions. But the bottom line is building an emergency fund is a must if you want to be prepared.

The Best Instant Paying Money Apps.

9. Tackle High-Interest Debt

High-interest debt is one of the most painful drains on someone's monthly budget, especially if they're trying to save more.

So, if you're currently struggling with debt, my advice would be to create a game plan to pay it off as quickly as possible. And in this case, I recommend turning to experts like Dave Ramsey and his debt snowball method.

This strategy focuses on paying off your smallest amounts of debt first. This lowers your monthly payments more quickly and helps you build up momentum to tackle the larger payments.

You can also work with a debt relief company if you're struggling. For example, companies like TurboDebt can help you consolidate your high-interest debt if you have $10,000+ in debts like credit card bills or personal loans. And this can be a faster way to lower your monthly payments and begin tackling your debt.

With a bit of money from your paycheck and a side hustle, you can use this strategy to chip away at painful debt and to start saving more each month.

Get a free consultation from TurboDebt!

10. Search For Missing Money You're Owed

Did you know that the Government and other agencies currently owe billions of dollars in unclaimed funds to people?

That's right: this “missing money” piles up over the years. And it happens when funds like tax returns, investment income, and all kinds of assets are owed to people but go unclaimed.

These missing funds also means there's a chance you can get free money by searching for money that's owed to you. And this is where a tool called BeenVerified comes in handy.

BeenVerified's tool searches through Government databases and public records to find missing income and assets that could be in your name. And according to its data, about 1 in 7 people have some form of income that's owed to them.

What's nice is that BeenVerified has a $1 7-day trial, so it costs almost nothing to make sure you're not missing out on owed funds. Afterwards, it costs $29.99 per month. But if BeenVerified's tool can find you a potential payday, the cost is well worth it.

Search for missing money with BeenVerified!

Extra Reading – Best $50 Sign Up Bonuses.

11. Automate Saving Money

One simple trick to save extra money each month is to set up automatic deposits from your paycheck into a separate savings account.

Your bank likely has this option. And doing this ensures that you're always putting a bit of money aside. Even if it's $25 to $50 a paycheck, every little bit counts, so start building good habits.

Pro Tip: Find the highest rates for savings accounts, money market accounts, and CDs with Raisin!

You don't pay any fees, and it only takes $1 to fund an account, and many Raisin partners are paying 5% APY or more!

Boost your savings rate with Raisin!

12. Lower Your Insurance Rates

Like calling your phone or internet company, you can sometimes get cheaper rates on things like home and auto insurance if you call your provider or shop around.

Insurance is a competitive market, after all. So, get in the habit of looking for new deals or lower rates with your provider and competitors every year or so.

Pro Tip: You can use a free tool called Champion Auto Insurance to quickly compare quotes from nationwide and local providers. People are saving $500+ per year on average. And it's completely free and just takes two minutes!

13. Start A Side Hustle

If you're living paycheck to paycheck and are struggling to make ends meet, starting a side hustle can help you save that extra bit of cash you need.

I've been side hustling for the last 5+ years. These hustles have always helped me save, and they're played a massive role in helping me grow my wealth.

Some popular hustles you can consider include:

- Using gig apps like Uber Eats or Instacart

- Making money online with survey sites

- Getting into online freelancing (I started with freelance writing)

- Doing odd jobs on Craigslist for cash

- Selling things you don't need anymore

- Starting some business, like a blog or YouTube channel

My side hustle tier list video ranks even more hustles if you want to explore some options.

Personally, I've used writing and blogging at The Budget Diet as my main hustles. And my blog made $272,000 in 2022, which just goes to show how a hustle can even grow into a full-time income.

14. Save Money On Energy Usage

Another easy way to save more money each month is to reduce your energy spending.

Simple tips like turning off the lights or tap when they're not in use is a great place to start. I also save money by using electricity-heavy appliances, like my washing machine, on off-peak hours.

And if you live in the United States, you can actually get paid to not use energy during peak times with various energy partners.

Utility companies are willing to pay people to not use their energy when demand is too high. So, you can use this link to explore partners in your state that can pay you to save energy.

This is a nice way to essentially get paid for doing nothing. And you can also feel good that you're reducing strain on the energy grid.

15. Lower Your Internet & Phone Bills

Did you know you can often save more money just by calling your internet, phone, and cable provider and asking them for a deal?

I did this recently with my phone bill from Virgin. I've been a customer for more than five years, so I called them and said I was thinking of moving to a new company with lower rates. They dropped my monthly bill by $10 to match the competitor, no questions asked.

I suggest doing this every six to 12 months. You'd be amazed at the easy savings you'll find!

Pro Tip: You can find extremely cheap phone plans with Mint if you're currently looking to lower your phone bill.

16. Start Some Free Hobbies

Did you know that the average American household spends almost $3,000 a year on entertainment according to Value Penguin?

That's a lot of dough. And while I'm not against spending money on dining, seeing a movie, or an outing with friends, you don't always have to spend money to have fun.

For example, you can try free or cheap hobbies like:

- Walking in a park or nearby trail

- Going to the beach

- Playing pick-up sports with friends

- Biking or running

- Having a picnic with friends

- Playing an instruments

- Getting books or movies from your public library

- Learning new skills, like chess

- Volunteering your time

Personally, I'm spending a lot more time hiking, walking, and in the gym these days. I feel a lot better, and my monthly gym membership is only $40, which is money well-spent.

17. Ditch Brand-Name Products

Ditching expensive brand-name products is another easy way to save more money each month.

This can include ditching designer clothing and shoes. But it can also mean buying more generic brands at the grocery store or pharmacy.

You can also consider buying non brand-name products in bulk to save even more. I do this at Costco or NoFrills sometimes, and I find it helps me save a bit of money in the long-run.

18. Try A No-Spend Challenge

A no-spend challenge is what it sounds like: a challenge where you can't spend any money for a certain amount of time.

Now, people have different versions and lengths of these challenges. For some, a no-spend challenge means absolutely no spending, whereas other people still allow spending on necessities like groceries. Some challenges also go for about a week, while others might go for 30 days.

Whatever the case, you can make a conscious decision to not spend money on non-essentials for a week or two. This helps you hold yourself accountable, and it makes saving money feel like more of a game than a chore.

19. Learn To Cook

Eating out is a massive drain on a monthly budget, especially if it's a daily habit. And besides, learning how to cook nutritious, affordable meals isn't rocket science.

When I was in college, one of the best money-saving hacks I used was to reduce my grocery and food bill and to always cook at home. But I still made nutrient-rich meals that hit the macros I was looking for.

If you want a helping hand with getting started, you can read this Food Network article that has 10 healthy dinner ideas that all cost about $10.

20. Start A Garden

An often overlooked but easy way to cut down on expenses is to start your own garden.

Now, you don't have to go insane here or to even have a large backyard that you completely fill with fruit and vegetable plots: even a modest in-house garden or small backyard plot will do the trick.

Starting a small herb garden or vegetable garden is an easy way to cut down on your grocery bill and to eat a little healthier. Plus, this is a fun and simple hobby to start out, so you might as well give it a try.

Some of my friends grew vegetables throughout school to save money in college, and it's cheaper to get started than you'd think. Seeds are cheap, and some bags of soil and cheap plant pots will quickly recoup their cost in grocery savings.

Final Thoughts

I hope this guide on how to save more money each month helps you cut down on expenses and keep more money in your wallet.

Personally, I use hacks like reward apps, credit card rewards, and side hustle stacking to find some quick wins. And I stick to a monthly budget and automate a lot of my savings so I stay on track.

You can use some of these tips and other information online to build a money-saving plan that works for you. Speaking to a financial advisor if you have specific questions can also be an excellent idea.

In any case, thanks for reading, and best of luck in your quest to save more money!

Want even more tips to improve your finances? Checkout:

- The Best Ways To Make $5,000 A Month.

- The Best Income-Generating Assets To Own.

- Is DealDash A Scam? Our Honest Review.

EarnIn Disclaimers:

1: EarnIn is a financial technology company, not a bank. EarnIn services may not be available in all states. Bank products are issued by Evolve Bank & Trust, Member FDIC.

2: Subject to your available earnings, Daily Max and Pay Period Max. Restrictions and/or third party fees may apply, see EarnIn.com/TOS for details.

3: EarnIn does not charge interest on Cash Outs. EarnIn does not charge membership fees for use of its services. Restrictions and/or third party fees may apply, see EarnIn.com/TOS for details.

4: Fees apply to use Lightning Speed. Lightning Speed may not be available to all Community Members. Cash Outs may take up to thirty minutes, actual transfer speeds will depend on your bank. Restrictions and/or third party fees may apply, see Cash Out User Agreement for details.