When it comes to making it through college, life can certainly be tough.

Between paying for tuition, rent, groceries, and still keeping up with a social life, financial stress is incredibly common for students. In fact, 70% of college students are stressed about their finances.

I'm a recent college graduate, but I remember a lot of that stress.

During college, I worked 10-20 hours a week as a Starbucks barista, and I also started several college side hustles and worked remotely to pay for tuition.

However, the main strategy that helped me to get through college was to live frugally. Earning money is great, but if you can figure out effective ways to save money in college, you'll be better off in the long run.

I want to take a trip down memory lane and share some of the most effective strategies I implemented during my time as a student.

If you're looking for the ultimate list of tips to save money in college, this is the post for you!

This post will contain tips surrounding:

- Food budgeting.

- Rent/utilities.

- Tuition, textbooks, and school expenses.

- Entertainment.

Let's get to it!

Saving Money In School – Food Related Expenses

Outside of rent, tuition, and textbooks, your grocery bill will be one of your main expenses.

The following tips are a great way to cut down on your student grocery bill and to save more money each semester.

1. Adopt A Simple Diet

One of the easiest ways to save money in college is to adopt a minimalist shopping plan.

My roommate actually devised the perfect college menu when he was in school that consisted of:

- Breakfast: Eggs and toast, or plain oatmeal mixed with yogurt and frozen berries.

- Lunch: Rice/beans, veggie mix (either frozen peas and carrots or some frozen green beans), and minced chicken or turkey.

- Dinner: Repeat lunch.

This foundation, plus a few extra items every now and again like fruit or vegetable, created an extremely lean but effective diet. Buy treats or something exciting every once in a while, but stick to the core diet.

The secret isn't to live off of Kraft dinner or Ramen (you'll just get scurvy and die this way).

I made a recent YouTube video that breaks down some of the best ways to save money in college, and it includes a section on how to keep meal planning affordable! 🙂

Just remember, you still need some variety (greater food variety actually has multiple benefits) but the key is to keep things fairly simple for your weekly shopping trips.

2. Buy In Bulk

One benefit of buying a limited number of food items is that you can shop in bulk to save money.

Find the closest bulk food supply store, Costco, or place you can stock up on essentials and go to town! Don't be afraid about buying an absurd amount of food in one go if it won't spoil and if the savings make sense.

3. Shop On Student Discount Days

Almost every grocery store in my city gave between 5-10% off on certain days of the week to students. I never diligently shopped on these days, but that was a missed opportunity.

Find out when stores offer student discounts and take note. If you can shop once a week for food and only on discount days, you can save money on your grocery bill throughout your entire degree!

Extra Reading – 14 Awesome Freebies For Students.

4. Meal Prep

Eating out or ordering delivery is the bane of college students. Events like drunken Uber Eats at 2am or exam season pizza binges can easily sink a student budget.

If you want to save money during college, you need to meal prep on a regular basis.

With your frugal grocery list in hand, it should be easy to plan out your meals and cook several portions every couple of days. Having readily available meals will reduce the likelihood you cave in and order food, and you can even freeze meals for backup.

I highly suggest investing in a cheap rice cooker and set of glass containers that you can use to make meal prepping a breeze.

5. Delete Temptation

After a complicated, tumultuous relationship with Skip The Dishes, one of my old roommates made the tough decision to delete the app from his phone.

Trust me, if you have apps like Skip The Dishes on your phone you will use them.

Delete the apps, unsubscribe from their email marketing, and just download the app again when you order food next time (it takes 30 seconds and this extra step makes it harder to purchase food on a whim).

6. Use Price Match Apps

Almost every major grocery store offers price matching these days, and you don't even need to use flyers or coupons anymore thanks to price match apps.

Personally, I use Flipp to quickly scan for coupons and deals or to price match various grocery items at checkout. I don't use it as often as I should, but it's an incredibly straightforward way to save money while grocery shopping.

I shop primarily at Walmart and NoFrills, and I still find great deals through Flipp, so this isn't just for fancy grocery store shoppers!

7. Use Receipt Scanning Apps

I've written a post on the best reward apps and I currently use Checkout 51, Receipt Hog, and Caddle to earn cashback for buying various items.

The downside to having a minimal grocery list is that you won't qualify for many of the offers on some cashback apps, but for random purchases like medication or cooking supplies/kitchenware, they can come in handy.

Again, these apps won't break the bank, but you can probably make $20-$40 a year without too much effort by using some of these apps!

8. Set An Alcohol Budget

Learning how to budget as a student is incredibly important, especially when it comes to food and alcohol.

I find that grocery bills for a single person are fairly consistent. Alcohol, on the other hand, is definitely more volatile based on events you attend, the season, or how many memories you're in desperate need of forgetting.

Set a monthly alcohol budget and stick to it.

I didn't do this in college, and while I don't drink often, grabbing pints at restaurants or random new beers from the Beer Store can add up surprisingly fast.

9. Buy A Flask

If you frequently go to bars or clubs while in school, I definitely suggest buying a flask so you can bring your own alcohol into an establishment.

A small flask is easy to sneak into a bar, and I've seen countless people do this without getting caught.

It's a simple but easy way to cut down on your alcohol spending, and you can drink in the bathroom stall like every other frugal degenerate has done before you. My friends and I did this frequently, and it saved a lot of money!

Seriously, make the $10-$15 purchase and bask in the amount of money you save on alcohol.

Rent & Utilities – Reducing The Cost of Living

Once your food and alcohol budgets are sorted, it's time to turn your money-saving focus towards another necessity: rent and utility bills.

10. Embrace Student Life

During college, I started out by paying $450/month to live in a student housing complex that was fairly close to campus, banks, and a grocery store.

I lived with fantastic roommates, and having multiple people in the same house helped keep utilities at a manageable level. Utilities never surpassed $50/month because of the shared bills.

In my final year of college, I moved in with my now ex-girlfriend (don't do this), paid $750/month in rent (don't do this), and probably spent closer to $80/month on utilities (don't do this).

The point is: take student life for what it is and don't rush to get out of it.

I deeply regret rushing through that phase of my life, and there were certainly many advantages to living like a student that also help save money.

Sure, I started work sooner and eventually got my own place, but I still could have finished my degree early while working a 9-5 job and stayed with my roommates for one more year.

Live with a bunch of your close friends in a rundown house for your entire college career and save as much money on rent as you can. Trust me.

11. Furnish For Free?

We never bought a single sofa for our student house, and I don't even think we really purchased chairs or much in the way of furniture in general.

If you're looking for ways to save money in college, stick with what old tenants left behind or find free items on Kijiji.

One of the funniest moments I had in college was when my roommates brought back a free Kijiji sofa that had springs falling out the bottom of it as they carried it through the door. The thing was incredibly uncomfortable but it really did bond us.

Extra Reading – How To Save $10,000 In A Year.

12. Work With Your Landlord

If you can learn how to do basic household maintenance or fix problems like clogged drains, toilet issues, or whatever else needs to be done, you can probably offer to do the work for your landlord in exchange for payment when problems arise.

In college, our landlord lived an hour away, and he made plenty of offers over the years for us to do work like painting or even to show the house to future tenants in exchange for money.

If you sense an opportunity to make some extra money (which can be applied against your rent), take action.

13. Negotiate Internet Bills

If you are in charge of paying the internet bill for your student house, make sure you stay as the account holder for at least one year/for as long as possible so you can eventually negotiate your internet bill.

My housemates and I never did this, but in hindsight, we definitely could have threatened to move to Bell and had Rogers drop their monthly price for us if we had just bothered to ask.

Extra reading – 7 bonus tips for cutting down on monthly expenses.

14. Don't Over-Pack For Residence Or Your First College Home

I was guilty of this for my first year living in a dorm, as well as my first year living in a college house with friends.

Trust me…you will NOT use that egg-McMuffin maker machine, or that crock-pot. You also won't wear half the articles of clothing you decide to pack (let's be real, sweatpants or jeans are king).

Keep things simple, and prioritize items that will improve quality of life, organization, and your overall health…pack vitamin C, cold medication, or a nice toiletry bag for the dorm showers, not a fancy kitchen appliance you'll never use. The easiest way to save money in college is to just be smart and realistic with your money, after all.

Saving On School Related Expenses

Once you've saved as much money as possible on the necessities, it's time to start tackling the most unfortunate part about going to school in the first place: the price tag.

15. Actually Apply For Scholarships

Everyone intends to apply for scholarships or competitions, but almost no one ever does (and this is why you have to start trying).

An entrance scholarship helped save me $5,000 in tuition at my college, and one of my college side hustles was to enter a marketing competition where I ended up winning $1,000.

Look around for opportunities for free money. They will promptly stop the second you graduate school, more or less, so take advantage of the chance while you still can.

16. Opt Out Of Useless Services

If you take a close look at your student fees, you will notice there are dozens of random associations and clubs that get a slice of the pie.

While you can't opt out of everything, many colleges let students recoup some of their tuition for things like dental or optical coverage if they are insured elsewhere.

If you already have coverage, don't be lazy: opt out of things you don't need to save a few hundred bucks.

17. Download PDF Textbooks

If you do some digging on Reddit, you can find plenty of great sources or methods to download your textbooks for free.

Sure, the edition might not always be correct, and you have to navigate a confusing labyrinth of sketchy Russian sites and viruses to find what you're looking for, but it is worth it.

Plenty of my friends downloaded textbooks, and the worst that ever happened was a slap on the wrist from Campus IT support.

If you can't find textbooks to download, you can try shopping at Abebooks (this is where I bought all the books I couldn't get for free).

18. Sell Textbooks

If you're going to end up with a bunch of electronic textbooks versions on your laptop…I mean…you might as well…

Selling textbooks online for $10 a pop was the easiest, fastest money I have made in college.

Students are always looking for cheap alternatives to the criminally expensive textbooks profs push, and you will sell textbooks like hotcakes through various Facebook groups or even local classifieds.

Extra Reading – Sell College Notes For Cash.

19. Don't Buy Textbooks

This is by far the most straightforward tip to save money in college but no one seems willing to do this for some reason.

Sometimes, you don't need to buy a textbook.

For example, I took a stupid but required course called ‘Individuals and Groups in Organizations.' The textbook cost something like $120.

The course was essentially about learning how people function in the workplace, and was some social well-being bullshit that is all common sense anyways.

Didn't buy the book, did fine in the class, and didn't waste money. Textbooks are resources, and if you don't need the resource, don't pay for it. Besides, you can usually rent textbooks from the library if you need to study a specific chapter.

Extra Tips For Saving Money In College

Once you've cut costs on food, rent, and school expenses, you can use these other simple methods to save even more money.

20. Use A Cash back Credit Card

Forget what they say about being too young to use a credit card. If you can drink, vote, and legally marry someone, learn how to use a credit card and start earning cash back without overspending.

I used a credit card all throughout college, but I was foolish and never got one with cash back rewards. Even if you receive 1% cash back, it will add up over the years.

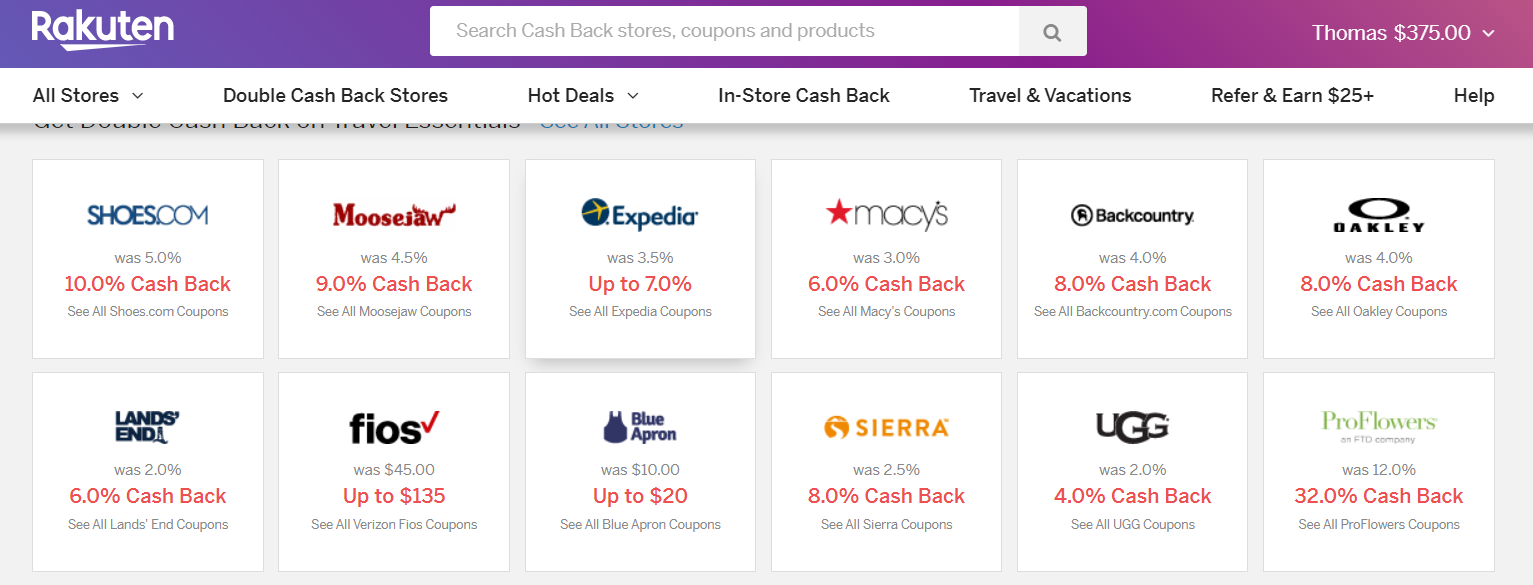

21. Use Cash back Apps

I've written posts on ways to save money when shopping online or cashback apps you can use, and while they don't lead to an insane amount of savings, getting in the habit is worth it.

Shopping online can already help save money, so you might as well use some cashback apps to recoup even more cost.

I personally use Drop, Ebates, and Honey at the moment to save, and this is an easy way to recoup $100+ a year at least.

These programs are free and one of the easiest ways to save money in a pinch if you're looking for more options.

Checkout our Drop app review and Honey extension review for all the details!

22 – Take Advantage Of Student Deals

If you subscribe to services like Amazon Prime, Spotify, Apple Music, or other subscription services, you should be on the lookout for student prices.

If you have a .edu email, you can usually signup for student deals during college and even afterwards for as long as the email account stays active. Long story short, avoid paying full price for as long as you can!

Extra Reading – The 8 Best Amazon Price Trackers To Find Deals.

23 – Use A High-Interest Savings Account

Even if you don't invest your money while in school, you should at least park your money somewhere it can earn interest.

Personally, I used Tangerine's (Canada only) high interest savings account to save money in college with whatever spare money I had between semesters, and it added up.

If Tangerine isn't your thing, you can use other high interest savings accounts or take a look at apps like Peak Money!

You can also try out the CIT Savings Builder Account to earn 1.45% interest on the money you save!

24 – Tax Refunds

I'm no tax expert, but I do know there are plenty of ways to save money as a college student thanks to various tax laws.

If you can claim your rent and tuition while informing the government that you are basically broke, you should be able to get a decent of money back on your tax return (if you have a job) or as benefit payments.

Again, look into the laws for your given country/state, but don't pass up on free money!

Final Thoughts

College is incredibly expensive, and money can be tight while you pursue an education, but there are ways to reduce financial burden and stress.

Stick to a budget, live frugally, start a side hustle or pick up some work if you need to make ends meet, and just be smart. You can find ways to save money during college if you have a plan in place.

Additionally, remember that grades are not really that important if your resume can back you up, and please don't forget to live a little.

Catch you guys in the next one!

Tom and the boys of Greasy Gordon.