It doesn’t matter what kind of business you are establishing. What’s important is that you keep track of all your income and expenses so that you can pay your fair share of taxes.

When it comes to tracking mileage for working days and client meetings, most people don’t even bother because of the hassle it gives. With the MileIQ app, you can receive an accurate account of your business miles through the whole year and be eligible for a significant tax deduction.

If you are a freelancer who drives a lot for your business, you will want to check out this awesome life-saver app. In this article, we will tackle everything about the MileIQ app and its perks.

Overview

MileIQ is a well-known mileage tracking app used by freelancers and mobile professionals. It is an app that tracks the miles you drive for work and at the end of the year, gives you an IRS-compliant summary that you can use to deduct the miles you logged as a result of your job on your tax returns.

In an article by U.S. News & World Report in 2016, Chuck Dietrich, the chief executive officer of MileIQ, said that the average MileIQ user was able to deduct $6,500 from their taxes or from submitting the miles to their employer to claim for reimbursements..

If you are in a 15 percent tax bracket, a deduction of $6,500 can save you $975 in tax payments when you file your tax return.

The new and improved version of MileIQ allows the app to run in the background of your smartphone and automatically track the miles and your location.

You are not required to stop and start the app to record the miles. It does all of the date, time, and mileage tracking automatically when it senses that you are in the car.

MileIQ picks up the location of the start and end of your trip, and since your phone is most likely always with you, you are always tracking your miles effortlessly.

How Does MileIQ Work?

After you download the app on your smartphone and finish setting up your account, MileIQ automatically begins logging the trips that you take in your car.

So, whether you drive 30 miles for a sales car or go to a party or a concert, MileIQ will log it.

Driving for work is considered to be different than driving to a party or a concert so the app enables you to categorize your trips according to the purpose of your trip – personal and business. You can easily mark a concert as a personal trip and the app would not include those miles in the end-of-the-year calculations.

Custom categories can also be setup in the MileIQ app. Users can record their own personalized business hours, so any driving made outside those hours will be classified as personal automatically. MileIQ also gives you full control over adding drives and editing your previous trips.

Once you sign up for MileIQ, you can drive normally and it will capture your drives automatically in the background. MileIQ gives you a variety of features that will help you track and report your driving more effectively. You can also add vehicles, name frequent locations, and even include custom purposes so you can track to a higher level of detail.

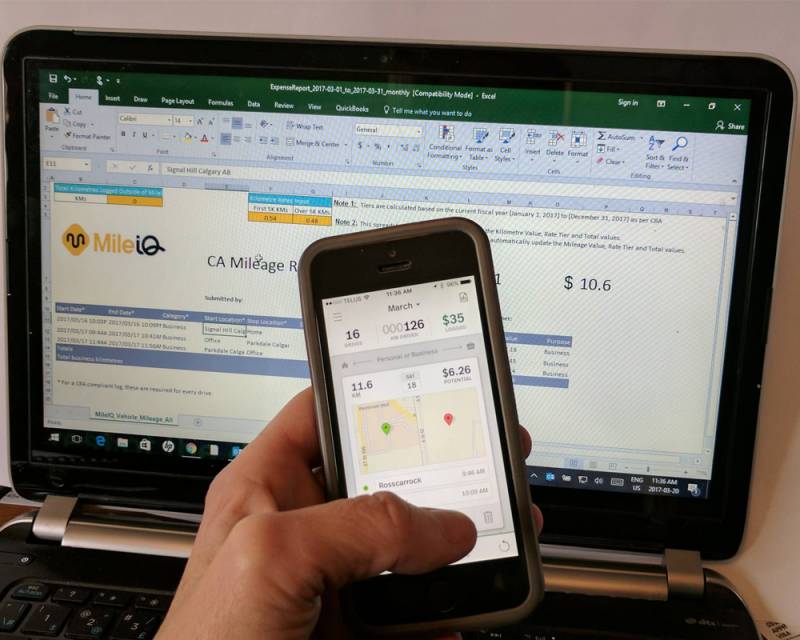

The MileIQ app has the ability to name certain routes you take so classifying them will be easy. Its convenient web dashboard allows users to manage their driving history, create mileage expense reports, edit any default miles, and more. Notes can be added in every trip for clarification and users can add and change vehicles any time.

After a drive is completed, a drive card that includes information such as start and end locations, the potential value of the drive, and the mileage associated with the drive will be shown.

At the end of the year, MileIQ will generate an IRS-compliant form that details the miles that you drove for work and the resulting deductions you are eligible for.

There are some things that you should keep in mind. The first is that MileIQ will only work for you if you are itemizing deductions. Basically, you will have the choice of taking a standard deduction that the IRS gives you or choosing to itemize them, which is much like a fancy way of saying, “list all your deductions yourself.”

Many people choose to itemize their deductions when what they get to deduct with their own list is more than what they would get to deduct with the standard deduction of the government.

If you are itemizing your deductions, the only way you can avail the mileage deduction is if what you are going to deduct amounts to at least 2 percent of your adjusted gross income (AGI). To determine that, multiply the number of miles you drive for work every year by $0.575 which is considered the per-mile deduction amount.

For example, if your AGI is $40,000, then you must be able to deduct at least $800 in mileage.

Note: You cannot avail a tax deduction for miles driven once you get reimbursed by your employer.

Product help can be accessed through the MileIQ Help Center, which gives a variety of help articles on topics including Getting Started, Troubleshooting, Reporting, and the MileIQ Blog.

The MileIQ Plans

MileIQ is suitable for both the solo entrepreneur that needs to track miles for IRS and to organizations that need to adequately track the mileage of their employees.

You can try the MileIQ app for free and then upgrade as you require. Below are the pricing options and features for the app:

| PLAN | PRICE | FEATURE |

|

No charge | You can download the MileIQ app for free and record 40 drives per month. You can also have access to all the mileage logs and regular reports. |

|

$5.99 per month or $59.99 per year | You have the option to upgrade to having unlimited drives every month. You receive the same features, reporting and access to mileage logs but are no longer limited by cap of 40 driver per month |

How to Use MileIQ When You Are Self-Employed

There are several features that you will love about the MileIQ app and one of them is the ability to save the type of vehicle you use and adjust the mileage rate based on the type of drive you make.

- Categorize and track your mileage without thinking

When you are ready to go to work or to a client meeting for the day, you can simply pull up the MileIQ app on your smartphone and begin driving. It will track the miles from your starting location until the end.

You will be able to categorize the trip (personal, business, other) right then, or go to an online dashboard once every month to categorize the trips and add more information about them.

- Save money on your taxes

MileIQ claims that the average user is able to deduct around $547 per month in their business miles, which means that you will be required to pay less taxes at the end of the year.

You will not need to guess your miles, or try to come up with a decent figure when your accountant asks you about it.

The app already syncs to the rules and regulations of the IRS for the current year so you do not have to wonder if you are receiving the correct mileage deduction or not – you just need to keep track of your miles automatically throughout the year. You can view them in your MileIQ app and dashboard when you want to.

- Deduct the cost of the MileIQ app as a business expense

One of the best things about the MileIQ app is that the amount that you pay for your premium subscription is considered a business expense – so you can take that as a deduction on your taxes too.

If you work as a freelance photographer, you can deduct the cost of the app and all the drives to and from your client meetings, shoots, and other appointments.

- Directly send reports to your accountant

Instead of being stressed out when your accountant contacts you to ask you to turn in the number of your miles, you can simply produce a mileage report. You can export the categorized information into a formatted PDF or CSV file, and easily forward it to your accountant.

The app will do all the heavy lifting for you and your accountant will think that you finally have your taxes organized!

- Track moving miles and personal drives

When you decide to move to another place, you can use the MileIQ app to track your moving miles, what’s more is that you can still deduct your moving expenses even when you are self-employed.

You can also give MileIQ the hours you work during the day and the app will classify the drives outside of those hours as personal.

Cons in Using the MileIQ App

Not every app is considered to be perfect and MileIQ does have a slight drawback. Unfortunately, most iPhone users turn off the Location Services on their phones because it drains the battery. If you forget to allow the MileIQ app to run in the background before you start your drive, you can only input the information manually through the online dashboard.

You would also not be able to manually add a drive inside the app, but is not considered to be too big of a deal. It just means that you will have to wait until you have access to a computer and log into your account to add any miles that were not tracked by the app.

Conclusion

How is an app like this a huge help? Say you are paying a certain amount for every mile you drive and in order to get paid for the miles, you had to write out your trips on a printed-out spreadsheet.

There will surely be times that you forget to bring the spreadsheet with you, so you will have to look for other things to write down the mileage numbers on and then remember to enter them when you finally have your spreadsheet. You may not lost out on mileage but it will be kind of annoying to have to bring a spreadsheet around with you to make sure that you get the numbers exactly right.

This is where apps such as MileIQ becomes super-helpful. You do not even have to think about logging miles because the app is already running in the background while tracking every trip you take.

Keeping track of the miles spent has always been a difficulty in the part of freelancers and employees who receive mileage reimbursements from their employer.

MileIQ is not the only miles tracker that is available on the market but it is considered as the most popular one, and definitely for a good reason. The user experience when using the MileIQ app is simple and straightforward. The app gets amazing reviews from users on both the iTunes and Google Play stores, with most people commenting on how easy the app is to use.

Users may be turned off by the fact that you have to pay a monthly or yearly fee to use MileIQ, but remember that you can still record that as a business expense which you can apply to your deductions.