In our world today, there have been a lot of improvements in terms of technology. Instead of sending letters through snail mail, we can now send our loved ones e-mails. We can even talk to them in real time using chat applications such as Facebook Messenger, Whatsapp, Viber, and the like. We can also speak to them through video calls using Skype, and other video messaging applications.

With these technological advancements, there has also been an introduction of money transfer apps where people can instantly send and receive money to and from other people from anywhere in the world. You can now also stop saying the phrase, “the check is in the mail” as various applications now allow people to make simple mobile payments.

These kinds of mobile applications usually streamline the process of mobile payments and money transfers. They usually only need the user to have access to an Android, iOS, or a Windows-powered smartphone. They only often require you to have the e-mail address or the mobile number of the recipient.

These apps may likely be the cheapest way to send and receive money, and many of these services are free of charge if utilized for personal use. These services are known as peer-to-peer payment services. They are regarded to be handy and useful in a lot of situations as people can make use of these kinds of services if they want to send a monetary gift to their child, split a bill with a friend, or even pay their rent without having to issue a check.

However, when it comes to apps that involve money-transfers, there is no denying that a lot of people fear about the security of their transactions. We are all aware that the world has already experienced a lot of information and date hacks and breaches throughout the years. So, to help you ease your uncertainties and let you eliminate potential frauds, we made a list of the best money-transfer apps to send and receive money using your smartphone.

Number 10: Xoom Money Transfer

Xoom enables its users to receive and send money all over the world. The app highlights low transfer fee charges, status updates, locked-in exchange rates, and push notifications regarding any of your sent or received money.

Quick Money Transfers

Xoom also features fast money transfers. You just have to sign up so that you can start sending money within minutes. You just have to have your recipient and payment information.

Easy Tracking

You can also easily track your transfers and stay updated with the status of your transactions through text and email updates and notifications. You can also have online access from your computer or your smartphones. You can even opt for live customer support and call their friendly support staff who are available 24/7.

Quick Send

You would not need to enter your information all over again as Xoom securely stores the information of a user so that you can make use of their simple two-step Quick Send feature on your next transfer transaction.

Xoom Calculator

Xoom offers their users with a fees and exchange rates calculator that will help their customers learn the price of the transfer transaction as well as the amount that their recipient will receive based on the exchange rates.

You can easily transfer money to your family and friends by completing these steps:

- Sign up for a free account on the website (www.Xoom.com) or their app.

- Choose a money transfer option, including the name of the recipient and amount, country, and delivery method (cash pickup, bank deposit, or door-to-door delivery).

- Enter the information of the recipient, including his/her complete name, home or office address, the name of the bank and his/her account number.

- Enter the payment information. You can select to pay from your debit or credit card or checking account. (Note: Xoom does not allow cash as a funding source.)

- Review the information and confirm the transfer transaction.

Your recipient can choose to receive the transfer in either the US dollar or the local currency.

How much do Xoom's services cost?

The service fee of Xoom varies depending on the country to which the sender is transferring the money, the source of the fund, the payout currency, and the total transfer amount. Users will pay the lowest fees if they transfer the money via a bank account in the United States.

Your transactions can take up to a maximum of four business days for Xoom to receive the funds from your bank. The processing of your transaction can be faster if you use your debit card or your credit card where the fees may slightly be higher.

Number 9: Western Union

The Western Union app does not only allow users to transfer money among family and friends, but it also grants the user the ability to send the money to more than 200 countries and territories around the world. It also allows their users to know the cost of their money transfers, and provide the listings of all the branches of Western Union.

The name of Western Union is well-known in many countries across the globe. Western Union has made it seem effortless to transfer and receive money over long distances for more than 160 years.

Western Union Options

You will discover many options for transferring and collecting funds, such as mobile deposits, cash pickup, and many more. The variety of options that are offered by Western Union varies from other online money-transfer apps.

How much do the services of Western Union cost?

International money transfer charges differ depending on the transfer method that you use. The best way to see how much you will need to pay is to enter your transfer details into the price estimator of Western Union.

Western Union exchange rates

You will need to consider the exchange rate when you send money overseas. The rates of Western Union are regularly updated based on the market. You can learn the rate that applies to your transaction by clicking Estimate Price at the Western Union app.

Western Union Transfer Types

There are many ways that you can send money overseas using the services of Western Union, beginning with the ease and convenience of online money transfers. The next choice is to initiate a transfer via phone. You can also opt to visit one of the many branches of Western Union for a face-to-face transaction with the use of cash or a debit card.

With Western Union, the recipient of your money transfer transaction can collect the cash that you have sent by:

- Cash pickup – Cash transfers that are sent by phone, in person, or online are available for pickup within minutes at any of the agent locations worldwide. Note that the transfers from your bank account can take a maximum of three days to arrive.

- Mobile wallet deposit – Funds that are from an agent location or those that are sent online are deposited within minutes.

- Bank account deposit – You should expect to wait for a maximum of three days for funds to arrive if you choose to pay with a debit or credit card online, while the transactions from your bank account online or by cash at an agent location can take a maximum of five days.

- Prepaid card – In selected markets, you can have the money that was transfer loaded onto a Western Union prepaid card.

How do I use Western Union?

Western Union offers their users several ways for them to send their money. You will need:

- A Western Union account

- Valid payment method – You can choose to pay via debit card for the fastest and cheapest transfer of Western Union or use a bank account or a credit card.

- The name and contact details of your recipient -If you are sending money to a bank account, you will need the bank name and the account number of your recipient. On the other hand, if you are sending a prepaid card via home delivery, you will need the address and the phone number of your recipient.

- Your contact and payment information – You will also need the account number or card number and security information for the account that you are transferring the money from.

Note: If the recipient of your money transfer is picking up the money that you have sent in person, remember to inform them to bring along a valid ID.

Number 8: Snapcash via Snapchat

Following a new partnership with Square Cash, Snapchat offers its users the ability to send money easily to anyone who is 18 years old and older. The user will just need to enter the money ($) sign, followed by a numeric value and Snapchat will send the money directly from the user's bank account or debit card.

The said feature of Snapchat allows its users to easily send money to one another through the chat portion of the app. Other than being over 18 years old, you must also have a debit card.

Signing up for Snapscash

To be able to link your debit card, Snapchat requires that you provide your card number, the expiration date of your debit card, your 5-digit billing zip code, and the 3-digit CVV number that is at the back of your debit card.

Snapcash Sign-up instructions:

- Tap the Profile Icon that is located at the top-left of your profile screen.

- Tap the settings button.

- Choose ‘Snapcash'

- Choose ‘add card.'

Sending Snapcash

Sending money via Snapcash is simple. The catch is that you cannot cancel payments after they have been completed.

Sending Snapcash Instructions:

- Go to a chat with your selected friend onto the Friends Screen on Snapchat

- Type the amount that you want to send. (For example, $20)

- Choose ‘Add Cash' to turn that into Snapcash

- Click ‘Send' to send the money to your selected friend from the debit card that is linked to your account.

Swipe-to-send Instructions

- Go to a chat with your selected friend onto the Friends Screen on Snapchat

- Type three dollar signs ($$$) into the chat

- Choose ‘Add Cash'

- Swipe up to send a dollar and swipe down to exit Snapcash and confirm the amount

Receiving Snapcash

Once you have already linked a debit card to your Snapchat account, it would be easy to receive any Snapcash as it would automatically be deposited into your account.

If you have not signed up for Snapcash yet, you will receive a message that says ‘Tap to Receive $' when someone sends you money via Snapcash. You can easily tap the message and link your debit card to receive the money.

You must take note that the recipients of Snapcash have only 24 hours to successfully link a debit card after a money is sent to them. After 24 hours, any unclaimed ‘cash’ is sent back to the bank account of the original sender. The process usually takes a maximum of 2 days.

Snapcash Settings

Users can change their settings by going to their account settings and tapping ‘Snapcash.'

- Debit Card – users can choose to unlink their debit card by tapping the ‘X’ that is next to their debit card number.

- Security Code – users can toggle ‘Security Code’ in order to require the users to enter the CVV number that is found at the back of their debit card any time that they send Snapcash. This can help make their account more secure.

- Transactions and Receipts – users can review the payments that they have both sent and received.

Number 7: Chase QuickPay

Using Chase Quickpay is easy, you just need to start out by launching the app, enrolling via the payments and transfers option, selecting Quickpay and clicking the enroll now button. You also need to register and verify your email address and mobile number.

Sending Money via Chase Quickpay

- Log On – To send money, you must log on to your Chase account using the Chase Mobile® app.

- Select Chase Quick Pay – Tap the Nav Menu that is located at the top left of the main screen of the app and select “Chase QuickPay.” From here, you have the option to choose ‘Send Money.' You can even request money if you need to receive a payment from someone. To send, choose “Send Money.”

- Send a Payment – You need to follow the on-screen instructions to send a payment. You have the option to send money to an existing recipient or add a new recipient.

- Verify Information – you must review all your payment information and check if they are correct, then click ‘Submit.'

Accepting Money via Chase Quickpay

- Email or Text Notification – To accept the money, you will receive a notification via an email or a text message which informs you that a payment is waiting to be accepted.

* If you are not a customer of Chase, you must choose ‘Accept Money' within the message and follow the on-screen instructions to enroll.

- Select Chase Quickpay – Tap the Navigation Menu that is located at the top left of the main screen and select ‘Chase Quickpay.'

- Accept Money – Select ‘To do list' and select ‘Accept Money.'

- Confirmation Page – On the confirmation screen, you will be informed on when to expect the money. If the payment is done between two Chase customers, the funds are usually available on the same day.

Even though the customers of Chase have access to a number of banking options within the smartphone application of Chase, non-customers that have valid email addresses can also send and receive money using the QuickPay feature of the bank.

Number 6: Square Cash

Using a simple link to the debit card of the user, Square Cash allows its users to quickly and easily receive, request, or send money to and from family and friends. Perhaps the most useful feature of the app is how quickly it deposits the money into your bank account once the transaction is completed.

![]()

Steps to Sign Up for a Square Cash Account

- Visit the iTunes store or the Google Play store and search and download the Cash App.

- Open the app and enter your mobile phone number or email address. Tap next, and you will receive a confirmation code via an email or text message.

- Select your primary use for the Cash App. You can choose either Personal to exchange money exclusively with friends and family, or Business to accept payments for goods and services.

- Follow the on-screen instructions to finish the signup process and make sure that you link your bank account so that you can send and receive money.

Using the Square Cash App for Personal Use

If you use the Cash App to send and receive money from family and friends, you must select Personal Use when you create your new account.

Sending and receiving money is free of charge when you use it for personal use. However, there is a three percent charge when personal payments are sent from a credit card. On the other hand, sending a credit card payment to a merchant using Cash for Business is free of charge.

Deposit Settings

With the Square Cash App, you are in full control where your incoming payments will be deposited as you are given two options:

- Auto Cash Outs turned Off – Choose this setting if you want to keep the funds from your incoming payments for future use.

- Auto Cash Outs turned On – Choose this option to directly deposit funds to your linked bank account every time someone sends you a payment, select this setting and pick your preferred deposit speed.

Cash App is made available to the residents of all 50 States of the United States of America. The user must be 18 years old or older and located within the United States to use the services of Cash.

Cash is not available in territories of the United States such as Guam, Puerto Rico, American Samoa, Northern Mariana Islands, and the U.S. Virgin Islands or outside the United States of America. Users would not be able to make use of the Cash app while living abroad, travelling internationally, or residing on military bases that are located overseas.

Number 5: PayPal

PayPal is considered as one of the oldest money transfer applications that are available. Even though receiving and sending funds takes a longer with PayPal, it does offer the ability to make use of its services to pay for purchases at numerous establishments.

PayPal has been the standard in making anonymous payments on the internet for many years. It is considered to be very secure since people are not required to have a check or a credit card. It is also used internationally and is extremely common as it is one of the oldest payment services on the internet.

How to Send Payments via PayPal

- Enter the email address or mobile phone number of the recipient, and the amount and currency that you would want to send.

- Select your preferred way to pay and send it securely.

- Easily track your spending. You will receive a notification whenever you perform a transaction.

PayPal recently launched a new feature called PayPal.me that lets every user have his or her own URL. To be able to pay or get paid, you need to send the URL along with the amount via a text or an email, and the recipient can quickly complete the transaction.

PayPal Fees

PayPal is free of charge for anyone, except for merchants if you fund using a bank account. However, payments that are made using credit cards are charged with 2.9% + $0.30 every transaction. The same charge is applied when you receive money for goods and services instead of receiving money from family and friends.

Number 4: Google Wallet

Google Wallet is like a digital wallet that you can easily hold in the palm of your hand. It makes it easier to send and request money from friends that are within the United States. You can even use the fingerprint sensor of your smartphone to access the app.

It has a user interface that is minimalist in design and easy-to-understand. With Google Wallet, money is instantly transferred into the bank. You can easily send money to someone by using only their email address or phone number even if they do not have the App.

You can also receive money directly into your bank account as you can select a default payment method wherein any money that is sent to you will automatically be transferred to your account without the need to cash out manually.

You can also keep track of your shared expenses. With the app, you can easily track who still needs to pay you back. You can also make use of its services for occasional commercial transactions that includes accepting payments for services or collecting rent. You just have to make sure that the commercial payments setting is turned on.

Number 3: Apple Pay Cash

With the iOS 11.2 update, Apple sets its aim squarely at Venmo and some other payment applications that allow users to send money to their contacts directly through iMessage. For users of the iPhone, there is no longer a need to install a third-party app if the recipient uses an iPhone.

With Apple Pay, sending and receiving money is as simple as sending a message. Managing Apple Pay cash becomes easier with the Wallet App.

In a conversation, the user can simply tap the A symbol that is located next to the camera icon in iMessage and click Pay. The user can now select the amount and tap Pay. They can also utilize the service to request an amount from their contact. The user can easily send the message just like they would in any other service, and it will ask the user to confirm either with the use of Touch ID, FaceID, or their passcode.

The service is also compatible with iMessage on the Apple Watch and use Siri to send money. While the money is immediately made available in your Apple Pay balance, you should take note that it takes a few days for it to transfer the money to your bank account.

Setting up Apple Pay Cash

You can use Apple Pay to get paid right in the Messages app of your iPhone or by asking Siri without the need to download a separate app. You can make use of the cards that are already in your Apple Wallet.

To send and receive money via Apple Pay Cash, the user must be at least 18 years old and must be a resident of the United States of America. The user must also need the following:

- A compatible device that has a version of iOS 11.2 and later for iPhones or a watch OS 4.2 and later for Apple Watch.

- Two-factor authentication for the Apple ID. The user must make sure that they sign in to iCloud using their Apple ID on any device that they want to use to receive or send money.

- The user must also have an eligible debit or credit card in the Wallet app so that he/she can send money.

The user must also agree to the terms and conditions. The user might also be asked to verify his/her identity. After the acceptance of the Terms and Conditions, the user can now securely receive and send money to family and friends right from his/her iPad, iPhone, or Apple Watch.

Setting Up Apple Pay Cash in the Wallet App

Once someone sends you money via Apple Pay Cash, it is automatically kept on your Apple Pay Cash card. You will see your Apple Pay Cash card in the Wallet app, and you can use the money to send money to other people, make purchases via Apple Pay within apps, in stores, and even on the web. You can even transfer the money from Apple Pay Cash to your own bank account.

If you are setting up Apple Pay Cash for the first time, you will be required to set it up using your Apple ID.

- Tap Settings and choose Wallet & Apple Pay.

- Tap the Apple Pay Cash card and follow the onscreen instructions.

Once you turn off Apple Pay Cash for one of your devices, you can still make use of Apple Pay Cash on your other devices where you are signed in using your Apple ID.

Using Apple Pay Cash with a debit card is free of charge. However, there is a standard fee of 3% when the amount is funded with a credit card.

Number 2: Facebook Messenger

Facebook has recently launched a feature in its Messenger app that enables any of its users in the United States to send money via the app. When you are chatting with one of your Facebook friends, you can simply tap the dollar sign that is located above the messenger keyboard that is directly beside the tools for sharing stickers and photos.

If you cannot see it, you can click the ellipsis that is located on the right-hand side to bring up a list of other options. Once you have set up your credit or debit card, simply type the amount of money that you would want to send and click pay in the top-right corner.

How to Send or Receive Money via Facebook

- Create a new Facebook account or sign into your existing Facebook account – You will need to be active in Facebook to access the Messenger App and start sending money to your Facebook contacts.

- Initiate your transfer – Create a new message with one of your friends and click the dollar sign in the lower right corner of your screen. A smaller pop-up window will then ask you to enter the amount that you are requesting or paying and what the payment is intended for.

- Add your debit card. Input your debit card information and tap pay. The money will be withdrawn and will be directly sent to the debit account of your recipient as soon as your bank approves your transaction.

What Happens When a Facebook Friend Requests or Sends Money From Me?

- A message will be sent to your Messenger App – A request or payment notification will appear in Messenger just like any other messages that you receive in the app.

- Choose to accept or deny the payment request – Once you accept the request, the amount will be withdrawn from the debit account that is linked to your Facebook account. If you choose to deny the request, the person who sent the request will receive a notification.

- Choose to accept or deny a payment – Once you receive a payment, you can choose to accept it for immediate deposit to the debit account that is linked to your Facebook account.

Facebook encrypts the payments and user information to ensure the safety of your money and transaction details. It will also require you to confirm your identity at times with the use of pins or personal information.

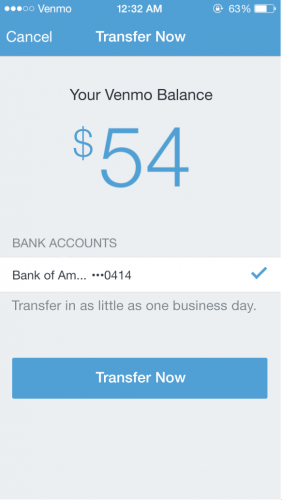

Number 1: Venmo

Venmo is more than just a new popular verb — “Venmo me!” — as this money transfer app makes it astonishingly easy to receive and send money from friends and family. Payments that are made from your Venmo balance through debit cards or a bank account will cost you nothing.

Venmo charges a 3 percent fee for credit cards. It also claims that their service has a “bank-grade” security system, so you would not have to be concerned about hackers getting a hold of your financial information.

How does Venmo Work?

Venmo makes it easier to make money transfers between individuals, enabling the consumers to transfer money to other people for various reasons. A user only needs a linked debit card, credit card, or checking account to use the service. Other than initiating payments, you can receive payments that can be kept as a Venmo Balance that you can use at a later time or have it cashed out immediately to your bank account.

Making use of Venmo for your transactions is very simple. You just have to choose who you want to request money from or send money to, write a description, and enter your desired amount.

Overall, we can say that the prevalence of smartphones, as well as the introduction of various tech startups have helped developed the sharing community. Money transfer services such as those that are mentioned above provide users with convenient alternatives to checks and cash.

If you decide to make use of these various money transfer applications, you must always remember the following:

- Make sure that you secure your financial information using a password. Always ensure that you use a password for your transactions. You must always make sure that you keep your password secure and safe.

- Do not let these new functionalities make the work of hackers and scammers easier. Always verify the identity of the person you are transacting with. Make sure that you are performing the transaction with the right person by talking to them before you complete the transaction.

- Remember never to share your personal information with people that you do not know so that your transactions will not be compromised.

All money transfer apps are susceptible to hacks, scams, and breaches. As you use these apps for your convenience, other people can also use these for their own advantage. So as these apps strive to make their services more secure, you should remember that it is also your responsibility to keep your account safe from hackers and scammers.