Even though the economy is improving and companies are offering more and more jobs, it’s still difficult for many people to live from day to day. Many are recovering from layoffs. Some have children to care for. Others have had their savings wiped out by unexpected medical bills, car repairs and other emergency expenses.

Even though the economy is improving and companies are offering more and more jobs, it’s still difficult for many people to live from day to day. Many are recovering from layoffs. Some have children to care for. Others have had their savings wiped out by unexpected medical bills, car repairs and other emergency expenses.

Many have stopped paying on their mortgages. Some have had cars repossessed. Others have maxed out their credit cards in order to pay for everyday essentials. Some have even declared bankruptcy.

All of these situations can put a dent in even the best credit score. Credit scores range from 300 to 850. The higher, the better. Getting a high credit score is not easy. While very few people have perfect credit scores – or even scores above 800 – many have excellent credit, which means a score of 720 or above.

If you’ve had credit issues in the past, your score may be around 400 or 500. This low number won’t help you qualify for loans or better credit cards, but don’t despair. While a perfect score of 850 may seem out of reach, a 700 credit score isn’t. A score of 700 is considered good, and anyone can achieve that in less than a year. It just takes hard work and discipline.

Want to know how to raise your credit score as quickly as possible? Here are some tips that can help.

Check Your Credit Report

If your credit score is unusually low and you don’t know why, it may be because there’s an error on your report. Errors do happen. Some people become victims of identity theft and don’t even know it.

You get one free credit report per year (get yours here). Review it thoroughly and be on the lookout for any accounts that look unfamiliar or late payments that were reported even though you paid on time. These factors can drop your credit score, so if you see anything that’s inaccurate, file a dispute with the creditor and reporting agency.

Make Payments on Time

Once you’ve cleared up everything on your credit report, the next step is to make payments on time. On-time payments account for 35% of your credit score, so this is very important. At the very least, make the minimum payment. Set up reminders so you don’t forget due dates.

If you’re having trouble making payments, contact your creditor for options. Do note that payments made a few days late will likely not show up on your credit report. Usually payments must be 30 days late for that to happen. However, you will get charged late payment fees by your creditor.

Late payments will drop your score for a long time, since they stay on your credit report for seven years. But once you get into the habit of paying on time, your score will start to increase again.

Pay Down Debt

One of the best things you can do to improve your credit score is pay down debt. Ideal credit card utilization is under 35% of available credit. This means that if you have a total limit of $10,000, you want to keep the balance under $3,500. Once you use more than 35%, your credit starts to take a hit. This may seem odd, but to raise your credit score, you need to have a lot of credit available and not use it. That’s harder than it seems.

Make a plan to dump as much money as possible on credit card balances. A good way to do this is start with the card that has the highest interest rate first. Pay that off and then go to the next card. You may also wish to focus on the card with the lowest balance first so you can pay it off quickly and feel a sense of accomplishment. Find a plan that works for you and stick to it.

Use Credit Wisely

If you’re trying to pay down a huge credit card balance, charging a new TV or computer to your card isn’t going to help. It’s going to make you dig a deeper hole and make it harder for you to achieve financial freedom.

Instead, pay with cash if possible. Use your credit card for necessities only. Now is not the time to be splurging on non-essentials.

Don’t Avoid Credit

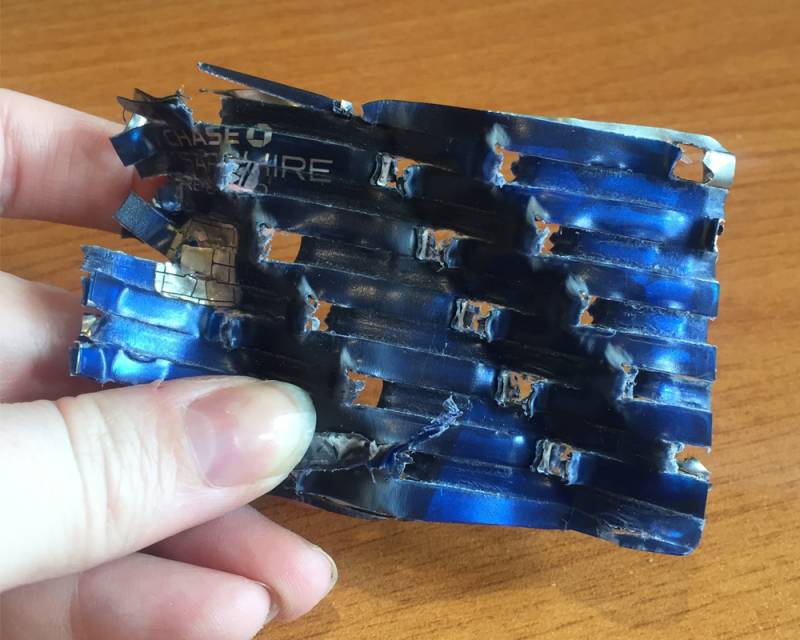

At the same time, you don’t want to avoid credit altogether. If you have recently gone through bankruptcy, you may be scared to use a credit card ever again. You may have cut them all up and resigned yourself to a life of no credit.

Never using credit again can actually backfire on you. If you never use credit cards, lenders have no way to determine if you are financially savvy. Your credit score will never rise back up because you you’re not using credit in any way, shape or form.

Instead of avoiding credit cards, apply for an easy one with a small credit limit. There are many cards available for those with challenged credit. Even a retail card may be a good choice for someone with limited credit. Get a card with a limit of $1,000 or so. Use it a couple times a month (charging a few hundred dollars at the most to keep utilization low) and pay off the balance in full each month.

By doing this, you show lenders that you can borrow money and pay it back on time. By making on-time payments, you are showing lenders you are responsible, and this will help you build credit.

Don’t Let Your Card Trap You

Many people either love their credit cards or hate them. Ideally, you don’t want to fall into either of these categories. It’s good to have them so you can use them as needed, but you don’t want to fall in love with them and depend on them for every purchase you make.

Many credit cards come with perks such as cash back rewards and miles toward travel, giving you an incentive to use them. Don’t use your credit cards solely to get the rewards. If you carry a balance on your cards, the interest will wipe out any rewards you receive. So be smart about credit card use.

Don’t Close Any Old Accounts

If you notice that an old credit card you no longer use is still on your credit report, you may be tempted to close it to “clean up” your report. Don’t do that. That old credit card will help boost your available credit. If it has a $10,000 credit limit, that’s $10,000 you can use toward your available credit. This can make a huge difference in reducing your utilization and boosting your credit score.

Keeping old accounts also boosts your credit history, which is a factor in determining your credit score. Those who have older, established accounts are more likely to have higher scores than those who just opened their first credit card within the past year. So while you might not like having that old account on your report, it’s helping your score in more ways than one.

Consider Different Types of Credit

While having a credit card and using it responsibly is a great start, lenders like to see various types of credit on your report. This may include mortgages, personal loans and installment debts, such as car payments.

If your credit is good, it may be a good idea to take out a small personal loan (under $20,000). You can use this amount to pay off credit card debt, so you’ll be stuck with just one payment per month (the loan payment). This can eliminate late payments and help you reduce your debt quickly.

To make this work, though, you need to be responsible with money. Many lenders deposit the money directly into your bank account, so you need to be disciplined enough to direct these funds toward paying off debt. If you use the money to splurge on unnecessary items, you’re only making your situation worse because you’re now adding a loan payment on top of your current debt.

Raise Your Score Today

You may be scared to use credit cards after dealing with previous issues, but avoiding them won’t help. The trick is to use them wisely and pay down balances as much as possible. By making payments on time and keeping utilization low, you can prove to lenders that you are more responsible with money.

A good credit score opens the door to many possibilities. You could receive credit cards with lower interest rates and higher credit limits. You may save money on auto insurance. You can trade in your car and buy a newer one. You can buy that house you’ve been saving for.

If your credit score is low, it’s not too late to change it. People make mistakes when they’re young, especially when it comes to money. Teens and young adults with their first credit card are bound to get into financial trouble if they haven’t been taught good money skills. They end up splurging on unnecessary items and getting further and further into debt.

People get older and wiser. Use the tricks in this article to show lenders that you’re more responsible now and on the road to better credit.

Sources:

https://www.bankrate.com/personal-finance/how-to-get-my-credit-score-above-700/