Reviewing your credit reports will help you balance your finances – your mortgage rates, credit card approvals, accommodation requests, and job applications depend on it.

Credit bureaus like Equifax, TransUnion, and Experian gather your data to create a report of your credit history – this is called a credit report. Credit reports will determine will give you a credit score which represents your creditworthiness.

Equifax and Credit Karma are two consumer credit reporting agencies that will give you a personalized credit report and credit score. Unlike Equifax which charges $17.95 a month, Credit Karma offers their services totally free of charge. The big questions are, should you pay to avail of Equifax’s services? Or use Credit Karma’s services for free?

Credibility and Safety

Founded in 2007, Credit Karma has established its name as a legitimate company that gives credit reports and scores for free. There are notions that Credit Karma is a fake website and a scam. The truth is it is a real website with a strong reputation. With mostly 4 and 5-star reviews, Credit Karma has served its clients well with not much complaints.

Much like Equifax, Credit Karma has millions of users who trust them. Equifax handles the information of more than 800 million consumers, whereas Credit Karma handles a much smaller group of more than 75 million people.

For ten years now, Credit Karma has protected the information of its clients from unwanted hackers. On the other hand, Equifax which has been founded in 1899, had a recent hacking incident that has put its name on the verge of bankruptcy. Millions of people have been affected by the breach, but this has not changed Equifax’s high credibility in its line of business. However, if your question is about safety, no one can guarantee that your data will remain protected with them.

Equifax and Credit Karma use an https connection with a 128-bit encryption that protects, secures, and encrypts all information that is transmitted from your computer to their servers.

This is not, however, a guarantee that it is invulnerable to hackers; an example is the recent hacking incident of Equifax. But what makes Credit Karma stand out is that they only have a read-only access of your information, this means that neither Credit Karma or a hacker can steal money from you or change any of your data.

THE WINNER: Credit Karma.

Although both companies are 100% legitimate, Credit Karma has stood by its promise to keep their clients’ information safe and secured. With Equifax’s recent hacking incident, it has become hard for its former clients to give back its trust to the credit agency giant. If Credit Karma can secure the data of their clients in the following years, it will be on its way to becoming one of the largest finance company in the world.

Cost and Benefits

You are probably familiar with AnnualCreditReport.com which advertises itself as the only website that offers free credit reports. What people do not know is that CreditKarma.com is a totally free and legitimate website which doesn’t require your credit card information – that means you don’t have to sign up for a free trial because everything is free from start to finish.

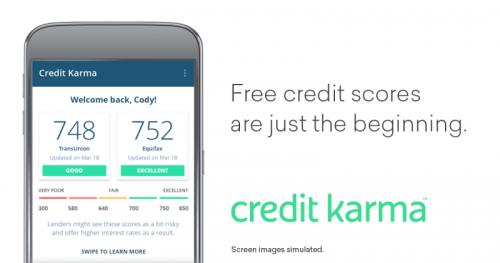

Credit Karma and AnnualCreditReport.com offer the same services. AnnualCreditReport.com is a free website that allows you to view your credit reports once a year, but what sets it apart from its rival is that, with Credit Karma, you can view your TransUnion and Equifax credit reports weekly.

The only downside with Credit Karma is it will not allow you to see your Experian credit report which AnnualCreditReport.com does, annually.

If you opt to pay for a service, Equifax’s cheapest plan will charge you $17.95 a month to monitor all your three credit reports. In addition, it will allow you to view your three bureau scores once a year and unlimited access to your Equifax credit score and report.

At $19.95 a month, Equifax will allow you to monitor your credit scores from all three bureaus and increase your insurance from identity theft to $1 million.

THE WINNER: Credit Karma. The best advice we can give you is not to limit yourself to one provider. If you want to save and still get the benefits of Equifax’s $17.95/month service plus more, you are better off with Credit Karma which will not charge you anything.

And if you want to see your Experian credit report, go to AnnualCreditReport.com which will allow you to view your Experian credit report annually for free.

Reliability

Now that Credit Karma’s enthusiasm for offering free credit scores is clear, it’s now time to judge the honesty of the scores they give. Should you trust Credit Karma’s scores? The truth is that the credit reports and scores of Credit Karma come from two of the three major credit bureaus, TransUnion and Equifax.

According to a Credit Karma’s chief consumer advocate, the company chose VantageScore 3.0 because it’s a combination of all three major credit agencies. And because of its transparent scoring model, it helps consumers better understand changes to their credit score.

But what is a VantageScore? VantageScores and FICO scores are both legitimate credit scores that banks use to determine your creditworthiness. FICO creates a score by looking at your file from the three major credit reporting bureaus – TransUnion, Equifax and Experian. VantageScore, on the other hand, boasts that its scoring model was created by the major credit bureaus.

Unlike FICO scores which requires a thick credit file to give you a credit score, VantageScores can calculate your scores with little credit history. Although both scores are legitimate, FICO reports that 90% of the banks will refer to your FICO score to make decisions.

Credit Karma’s reports and scores are not the same with Equifax’s as both have its own system of calculating scores. Since most banks will refer to your FICO score rather than your VantageScore, you should always know what your FICO score is.

One important thing you should note is that there are so many scoring models, and none of them is perfect. Lenders will look at your scores from as many scoring models as they want, and you don’t have a clue which one they will pull. Second, every scoring model’s rating is most likely in the same range; if you’re rated excellent at VantageScore, you are most likely to be rated excellent at FICO too.

Equifax generates FICO scores and VantageScores which they refer to as “Experian Credit Score.” It also generates Equifax Credit Score™ which is used to calculate a score for not just your Equifax credit file, but also your Experian and TransUnion credit files. FICO scores and Equifax Credit Score™ will predict similar types of credit risk but may sometimes differ significantly to each other depending on how different the scoring models calculate risks.

THE WINNER: Tie.

Although Equifax will generate three different types of scores, Credit Karma’s VantageScore is not in any way different from it. Equifax’s and Credit Karma’s credit scores will almost always be in the same range. No scoring model is perfect, and lenders will look at different scoring models to determine your credit score.

Customer Service

Credit Karma’s website does not show a phone number that you can call for immediate assistance. So in case you need to place, lift, or remove a security freeze from your credit report, you would have to ‘submit a request’ so you can be contacted by their support group. You are also limited to only four issues stated on their website, so if your problem is not in one of their four choices, you know you’re in trouble.

And in case you are wondering why they do not have a phone number, Credit Karma says they are all about using technology now and can help you out through email only. If this does not frustrate you, they also confirmed on their website that they do not offer any kind of phone support.

According to their website also, requests through email can take up to three business days before they can respond to you. But if you are a patient person and you think that you don’t need any emergency assistance in the future, Credit Karma is an excellent choice for you.

Equifax, on the hand, boasts an online request form for people who don’t want to wait for a customer service agent to talk to. Another option is their 12-hour, 5-days-a-week dedicated hotline for anyone who has questions. If any of the above information does not suit your preferences, they will also accept requests via mail; all that information can be found here.

Humans are essential. No amount of robot intelligence can defeat the services of humans. Although automation can be very useful in giving excellent service, any company that tries to do away with human customer service representatives will entirely lose business. It’s impossible to engage on a personal level with understanding, empathy, and compassion when machines are running your entire operation.

THE WINNER: Equifax.

It is no doubt that Equifax provides a better and more time-efficient way of solving and answering their clients’ needs and wants. Credit Karma had gone too far on taking advantage of technology. They have forgotten that no robot can suffice a human’s way of interacting with clients.

Verdict

Millions of people use Credit Karma to track their credit score. The company is highly transparent and offers services through VantageScore that works well for tracking your credit. Equifax works the same way but uses three different scoring systems; all of which are not perfect but will give you peace of mind when it comes to checking your credit. So whether you use that information or not is up to you.

Credit Karma and Equifax are both reliable regarding the services they offer. While Credit Karma passes 3 out of our four criteria for judging, Equifax has stood out in terms of customer service. This puts both companies at the same level of competence.

Our advice would be to pay for Equifax’s service while you use Credit Karma’s services for free.

Stay proactive and monitor your credit regularly so you can catch inaccuracies or fraudulent activities on your account. By monitoring these records, you can dispute inaccuracies before applying for credit.