Failing to manage write-offs, especially your mileage can cause a small business owner hundreds or thousands each year in potential deductions. Luckily, The Budget Diet can help. Here's a guide to help you find the best mileage tracking app to maximize your return this April.

Why Use a Mileage Tracking App

Small business owners need to not only work hard, but they also need to work smart. This means that along with focusing on revenue, they need to also consider their take-home pay

Working for yourself means a constant battle between increasing profits and managing expenses. Yet, many business owners are missing out on a huge opportunity. Deduct a major expense each time you get behind the wheel: your mileage.

Whether you’re a solopreneur or running a small business with a team of employees, chances are you are often in your vehicle. Are you are meeting clients? Delivering products? A full-time driver? The cost of travel for business can really add up. This is a write-off that can often be overlooked and can have a big impact on your tax bill each April.

![]()

The Rules For Mileage Deduction

Writing off your mileage isn’t as simple as coming up with a number come tax season. The IRS has rules that need to be followed in order to receive this important deduction. It requires a little effort up front, but the returns are well worth it.

The IRS allows for the costs of operating your vehicle to be deducted from your taxes. In 2018 business owners are allowed to deduct 54.5 cents for each business mile traveled between 01/01/18 and 12/31/18. While this may not seem like a significant amount, it will add up over the course of a year.

While your morning commute may be the worst part of your workday, this trip could potentially qualify for mileage deductions. According to the IRS rules, to have your commuting miles count toward your deduction, you need to have a qualifying home office and then be traveling to your small business. This would count as an office-to-office trip. If you do not have a qualifying home office, it's considered commuting miles rather than business miles and does not qualify for a deduction.

Uber and Lyft Drivers

With the popularity of personal driving services such as Uber and Lyft, more and more people are becoming their own boss by driving others in their personal vehicle. This type of employment offers the flexibility, hours and pay that makes it an enticing opportunity, but one where tracking your mileage is imperative. After all, if you are spending hours in your car each day, you are burning gas and inducing wear and tear. Failure to track your miles means you are literally allowing your profit margins to go up in smoke.

How do I log My Mileage?

Of course, tracking your expenses is not as simple as coming up with a number during tax time. The IRS wants to see a log of all your trips. It's important to note that there are rules around this deduction and failing to follow them could cost you during tax time. To qualify for deductions, your travel log needs to include:

|

With all of the necessary information required, logging the information the old-fashioned way with a pen and paper log could seem like too much work for so little reward.

Not Just for Business Owners

Tracking mileage isn’t reserved for small business owners. The best mileage tracking apps allow for customized reimbursement settings are a great tool for employees who have to use their personal vehicle for work-related trips. Mileage for off-site meetings, training, and conferences can also be deducted at tax time.

Moving for Work

If you are moving for work, you may also be able to deduct your mileage. You can claim a deduction of 18 cents per mile if you move more than 50 miles (other than a military order) and work full-time for 39 weeks in the next 12 months.

Volunteering

If you drive to volunteer at a recognized non-profit, you are able to deduct 14 cents per mile as part of your charitable donation. You need to be driving to personally volunteer and not offering a volunteer (such as your family member) a ride.

Medical Appointments

If your medical expenses equal 10 percent of your annual income (7.5 percent if you are 65 or older) you may be able to deduct 18 cents per mile for trips to medical appointments and the pharmacy.

Luckily, there are many mileage-tracking apps designed to make it easy for business owners and regular Joes to track their mileage with all the information required at tax time. After all, a simple 100-mile trip could put as much as $54.50 back in your pocket at tax time with just a few swipes on your phone screen. We have gathered a list of our top 11 for our readers to check out, download, and start saving.

Hurdlr

This all-in-one app makes it easy to track all of your business expenses (including mileage) in one simple to use app that also calculates your total income and taxes owed.

This app seems to have been designed to make tax time easier for small business owners. Not only does it track mileage and expenses in real time, but it will also offer views of your earnings and potential deductions.

Link accounts

With Hurdlr you can link your bank account, Paypal account, and any credit or debit cards you have, to easily keep track of your expenses and write-offs.

Ease in tax filing

One of the biggest benefits of Hurdlr is the ease in filing your taxes. In fact, you can even file them directly from the app! If using an accountant you can export all the necessary information at the touch of a button.

Manual entry

If you forgot to turn on the automatic tracking, you can always manually enter the information with Hurdlr’s step-by-step instructions. Check out our in-depth review of Hurdlr.

Everlance

This is a great download for a professional driver or if you are operating a fleet of vehicles for your small business. Everlance is available with limited options as a free download for both iOS and Android or you can upgrade and experience all of its abilities to make calculating your mileage a breeze.

Works with your other apps

Everlance runs in the background so while it may drain your battery, it allows you to access your GPS or other apps that are necessary for professionals who drive often such as Uber or Lyft drivers. This app can also be linked with your bank account to keep track of expenses and write-offs in cloud storage.

Premium services

With the free service, your trip data must be entered manually and can be exported into an excel file for tax time. The premium service includes automatic trip recording. This can be very useful if you have employees driving for you and you want to be able to check on their efficiency and use of the company vehicles. Of course, the standard mileage rate only applies to small businesses operating four cars or fewer.

Sherpashare

This highly rated app is a great choice for both professional drivers and small business owners. Not only does it include many perks to help you save money and share tips, but it’s also free to download on both iOS and Android.

Sherpashare boasts one-click trip classification, advanced trip-detection technology, and secure cloud storage.

Amazing add-ons

This all-in-one app features some amazing add-ons such as a financial management plan designed to help you take advantage of every deduction available, a driving optimizer to help you become a more efficient driver, and a forum for users to share money saving tips, the best deals in car accessories, and how to get lower insurance rates.

MileWiz

Not only is MileWiz easy to use, but it also boasts an incredible 95 percent accuracy rate. This means that there is no need to worry come tax time because you know your reporting is accurate. You can also export your tax information to CSV files for your tax professional.

With MileWiz you can pause the app for privacy when making personal trips, make manual adjustments, log additional expenses such as parking or tolls and categorize trips with a swipe. You can also add places you frequently travel, such as a client’s office.

Easy Log Book

We all love an app with the word ‘easy’ in the title, and thankfully this one does live up to its name. Easy Log Book is a simplified take on mileage logging with a simple start and stop button for reporting. It also boasts an easy to add a description for each trip. Reports are emailed to the user to be used to track travel in either miles or kilometers.

Android users have to sit this one out as it's currently only available on iOS.

Track my Drive

You can easily keep track of all of your travel on your laptop or mobile with Track my Drive. This app runs in the background of your phone calculating each trip automatically and then the user can easily classify each trip as personal or business.

While free to use on both Android and iOS, you will only have access to 10 trips a month. Since each trip is automatically calculated, most frequent drivers will need to pay for the premium membership. Luckily, it's one of the most affordable options at $8.99 for an entire year.

MileIQ

Classification between business and personal trips is as easy as swiping left or right with this mileage tracking app that is now included with Microsoft Office premium subscriptions. It boasts automatic mileage tracking and sends you weekly reports that can be further customized with their web dashboard. Their free service includes up to 40 drives each month and their premium subscription which includes extra features and unlimited drives is $5.99 a month.

Trip Log

If you are willing to put in a little work, Trip Log’s free plan is a great option for the small business owner. The free plan requires a manual input of trip data. It also offers coverage for up to five vehicles and an unlimited number of trips.

Moving up to the basic plan which is only $2 a month will get you comprehensive IRS compliant reports as well as auto tracking. The premium service at $4 a month, will also include a web dashboard, daily back-up to the cloud and the ability to sync between multiple devices.

Quickbooks Self-Employed

This app is a one-stop shop! Easily track expenses, deductions and know how much tax is owing each quarter.

While not a free app, this is one that finds an average of $4628 in tax savings each year, which is well worth the $60 annual fee.

Quickbooks Self-Employed allows the user to automatically track their mileage using their phones GPS. Users can also create and send invoices to clients, and track business expenses on the go. Any receipts can be snapped with your phone’s camera and all the information is easily imported. Best of all, the integration with Turbo Tax makes the end of the year tax filing easy.

TaxMileage

TaxMileage offers its users the ability to pre-configure their trip information. This helps ensure that all the important details are recorded for the maximum return and avoid any risk of rejection.

Reports are able to be exported as a PDF or excel file for easy information transfer at tax time. You can register multiple vehicles, multiple sources of reimbursements and personalize the purpose of your trip. You can track your trip in miles or kilometers as well as chart your fuel consumption and costs.

While not available as a free download, you can get one year for $29.99, two years for $39.99, and three years for $49.99.

FYI Mileage

iPhone users will enjoy the intuitive user interface and simple data entry that comes with the iOS app. Users are able to switch between miles and kilometers. Reimbursement rates and CSV and HTML reports can be exported via email and Wi-Fi.

The app is $2.99 and can be linked to your iPhone address book. Frequent trips are remembered and data can be exported directly to iXpenseIt.

Tracking your mileage is a great way for small business owners to see better returns at tax time. A simple download of the best mileage tracking app can add up to hundreds or even thousands of dollars.

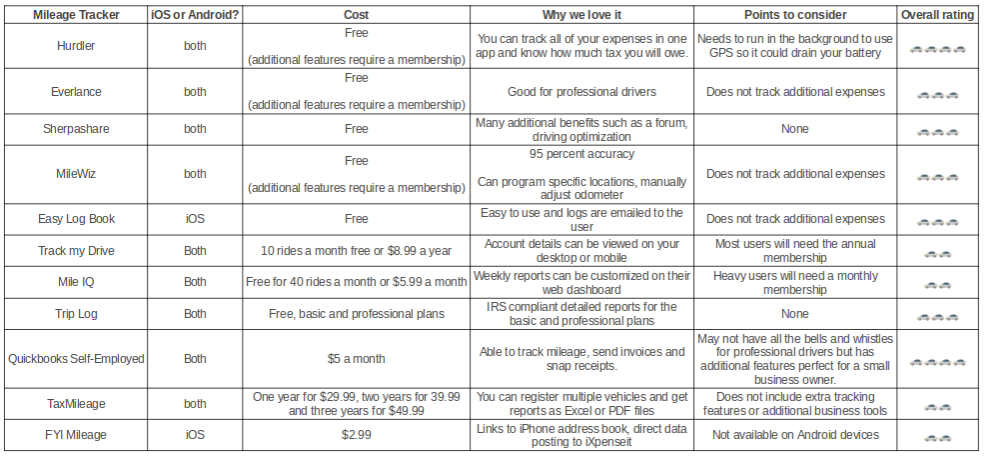

Best Mileage Tracking App Comparison Table

Safe Travels!

Tracking your mileage is a great way for small business owners to see better returns at tax time. A simple download of the best mileage tracking app can add up to hundreds or even thousands of dollars. It's important to consider the needs of your business before selecting the right app for you. Some include additional features perfect for professional drivers. Others are designed for multiple vehicles or users. Some even offer integration with tax software or additional features that are perfect for a small business owner.

What's the best mileage tracking app that you've tried? What other apps do you use to track your business expenses? Share your knowledge by letting us know in the comments!

Hi there.

Have your checked out Falcon Expenses? Falcon Expenses was founded in 2013 and is a mileage expense tracking app for your iPhone. Falcon offers three different ways to enter and track mileage expense. By entering your odometer readings, by entering the start and end address of your trip from which the driving distance and expense amount will be calculated. Also, there is a GPS mileage expense tracking feature that tracks your miles as you drive. All mileage expenses tracked, entered and captured can be easily organized into reports that can be sent to anyone — all from your phone. Falcon Expenses is fully mobile, empowering users with full functionality at the palm of their hand so that they never have to go to a desktop.

We would love to be included on your list.

Learn more here:

https://falconexpenses.com