More consumers are now opting to go digital when it comes to their banking institution and are choosing online-only banks. Simple Bank and Ally Bank are considered to be two of the leading online-only banks. Customers can count on these banks for good online banking platforms and low fees.

Two of the better names out there when it comes to online-only banking are Ally and Simple Banks, the latter of which offers its services through Compass Bank and The Bancorp Bank. If you’re wondering which is the right bank for you, read on as we take a deeper dive into these financial offerings, including what bank accounts they offer, their fees and more.

Even though both banks stand out, they do so in fairly different ways. For example, the Safe-to-Spend tool of Simple Bank can help you have a firm grasp on your budget while the high-yield savings account of Ally Bank makes it easy for you to bolster your emergency fund.

Ally Bank

At initial glance, you will notice that Ally Bank offers various financial products that range from savings accounts to long-term certificates of deposit to high-yield retirement accounts.

No matter what kind of account you open with Ally Bank, you can be assured that you will receive one of the highest interest rates offered in the industry. Even its basic online savings account earns interest that is well above the national average.

Ally also tries to be transparent regarding the charges and fees that you will encounter with an account. You would not be charged fees for standard checks, cashier’s checks, account maintenance, incoming wires, statement copies, and etc. You will only be charged for some occurrences such as returned deposit items and overdrafts.

To be able to have access to your money, you will be required to log in on mobile, get online, use an ATM, or call the bank. The customers of Ally Bank have access to more than 40,000 free Allpoint® ATMs in the United States and if you make use of a non-Allpoint® ATM, they could reimburse you a maximum of $10 per statement cycle on ATM charges.

Simple Bank

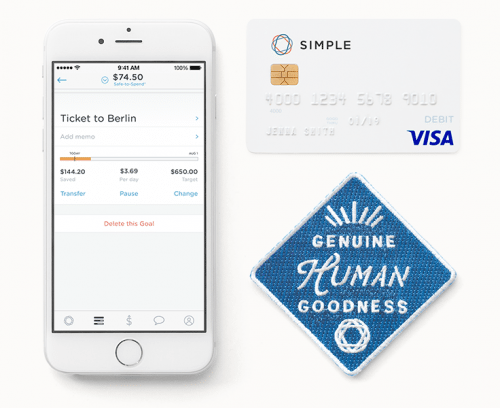

Simple Bank was established when its founders realized that many people were having inconvenient and complicated banking experiences. They strived to establish a bank that was easy-to-use. Working with The Bancorp Bank and the Compass Bank, Simple is able to give a more personalized feel to banking. This is especially noticed with its aesthetically satisfying website and mobile app.

It is important to note that Simple only offers checking accounts at the moment, this may not be noticeable when you first visit their website. You also do not have check-writing abilities with this account, which can be considered as a disadvantage for most people. However, their checking account does have numerous perks that make saving and banking easier and more automatic.

One of their services include Goals, a feature that allows you to keep cash in virtual envelopes for any expenses in the future such as buying a new TV or paying for rent. Simple also has a Safe-to-Spend® tool which automatically notifies you about the amount of money that you are safe to spend on a specific purchase. This considers your current balance, what you are trying to save for, and the cost of your possible purchase.

Simple goes even further as compared to Ally when it comes to refusing to charge additional fees. You would not be required to pay any fees for card replacements, Allpoint® ATM usage, and even overdrafts. However, because of these lack of fees, Simple would not reimburse you for any fees that you come across for non-Allpoint® ATMs.

It is vital that you know what you are looking for in a bank when you begin comparing them. For example, if you would want a bank that has a variety of accounts that you can open, you will want to opt for Ally Bank. However, if you are just looking for an easy and low-fee checking account that could help you in managing your money, choose Simple Bank.

Quick Comparisons

Listed below are some of the products and services that are offered by both banks with their interest rates and the amount of fees that they charge.

1. Checking Accounts

Both Ally Bank and Simple Bank offer checking accounts to their clients. Ally offers the Ally Interest Checking while Simple have the Simple Fee-Free Checking. Both have no monthly fees and also do not require minimum deposit amounts.

| Ally Interest Checking | Simple Fee-Free Checking | |

| Monthly fees | $0 | $0 |

| Minimum deposit amount upon opening | $0 | $0 |

| Interest on balances | a. For deposit less than $15,000: 0.10% APY

b. For larger deposits: 0.60% APY |

0.01% APY |

| ATM network | a. Access to thousands of Allpoint ATMs

b. Reimburses a maximum of $10 per month for out-of-network ATM fees |

a. Access to thousands of Allpoint ATMs

b. Does not charge for the use of out-of-network ATMs (the owner of the ATM may charge a fee); no reimbursements on ATM fees |

Both of the banks have low-cost options and excellent ATM access. You should note that you will earn more in interest with Ally Bank. However, the difference would not be noticeable unless you have a huge balance in your account. Both banks offer its clients access to the same large ATM network, so looking for a free cash machine nearby should be not be difficult.

2. Savings Accounts

Ally Bank offers a product called Ally Savings. It has an interest rate of 1.45% and it does not require a monthly fee. Simple Bank, on the other hand, does not have a savings account offering.

| Ally Online Savings | Simple Bank | |

| Monthly fees | $0 | Not Applicable |

| Minimum deposit amount upon opening | $0 | Not Applicable |

| Interest on balances | 1.45% APY | Not Applicable |

| Automatic transfer from linked checking | Yes | Not Applicable |

One of the best savings accounts on the market is offered by Ally Bank. The average rate on a savings account currently stands at 0.07%, partly compared with the APY of Ally Bank. There is no initial deposit amount requirement upon opening of the account, and it is easy to transfer money between your savings and checking accounts.

Even though Simple does not offer a savings account, its Goals tool could help you save money. You can also set up recurring and automatic transfers to these goals so you could stay on top of your savings goals. With Safe-to-Spend®, you could be less tempted to overspend as it shows what you can only afford.

3. Certificates of Deposit

Ally Bank has the Ally Certificates of Deposits (CD) interest rates while Simple does not offer it. The Ally CD interest rates have a rate of 1.75%-2% for a 1-year term and 2.25%-2.50% for a 5-year term. It also does not require a minimum deposit amount.

| Ally High-Yield CD | Simple Bank | |

| Minimum deposit amount upon opening | $0 | Not Applicable |

| APY on one-year term | 1.75%-2.00% | Not Applicable |

| APY on three-year term | 1.85%-2.10% | Not Applicable |

Some of the best CDs on the market are offered by Ally Bank. Some banks require minimum deposits of up to $1,000. However, at Ally Bank, customers can open a CD with as little amount as they would like. Term lengths vary, and rates are considered to be strong across the board.

4. Overdraft Fee

Ally Bank has an Overdraft Fee of $25 that is charged only a maximum of once per day while Simple Bank does not impose any overdraft fees.

| Ally Bank | Simple Bank | |

| Overdraft fee | $25 | Not Applicable |

| Overdraft protection transfer fee | $0 | Not Applicable |

| Extended overdraft fee | $0 | Not Applicable |

Both Ally Bank and Simple Bank keep their fees low. At $25, the overdraft fee that is charged by Ally Bank is already considered to be well below the national median of $34, and the bank caps these types of charges at a maximum of one per day.

The bank does not charge extended overdraft fees, and offers free overdraft protection. With Simple Bank, transactions that would result in an overdraft are usually returned to the customer or are denied.

5. Overdraft Protection Transfer Fee

Ally Bank does not impose an Overdraft Protection Transfer Fee; Simple Bank does not offer this kind of service.

6. Branches

Both banks do not have any physical branch.

7. Web and Mobile App Appearance

Even though the web and mobile apps of Simple are peerless and noticeably more polished and better-designed compared to that of Ally Bank, it is still true that both of these banks provide interfaces that are easy-to-use and both outshine almost all of its other competitors.

8. Customer Service

The customer services of Ally Bank and Simple Bank are available 24/7 by phone. Ally Bank offers more products and services as compared to Simple Bank which only offers checking accounts.

- Choose Ally Bank if you want access to a full array of banking products, if you consider earning interest to be important, and if you value having various ways to be able to reach the bank’s customer service, including online chat.

- Choose Simple Bank if you do not want to pay overdraft fees and if you need a tool for managing your expenditures.

9. Bank Experience

| Ally Bank | Simple Bank | |

| Branches | 0 | 0 |

| Banking apps (ratings from app store users) | 3.4 out of 5 stars for Android and 4.7 out of 5 stars for iOS | 4.4 out of 5 stars for Android and 3.9 out of 5 stars for iOS |

| Customer service | Available by chat, phone, email and social media | Available by phone and in-app messaging |

The Safe-to-Spend tool offered by Simple Bank separates it from the pack. Both Simple Bank and Ally Bank have excellent websites. However, Simple takes it a step further by offering its clients the Safe-to-Spend tool. By calculating the bills and savings goals of its clients, the said service highlights the amount you can afford to spend on purchases that are considered to be nonessential.

However, Simple does not offer its customers quite as many means to reach their customer as Ally Bank does. The online chat service of Ally is reliable and it even lists estimated wait times so their customers can continue with their day if the virtual line is too long.

Conclusion

Overall, Ally Bank and Simple Bank are excellent options that have distinct strengths. They are both top-notch online banks, and the services that are offered by these banks will come as a welcome change of pace for people who are used to high fees.

- If you want some help in getting a much better overview of your daily finances, you should opt for Simple Bank and take advantage of their Safe-to-Spend tool.

- However, if you would want separate savings and checking accounts, the strong suite of savings products of Ally Bank will serve you well.

You must remember that it is always important to consider your own specific banking needs and requirements before you open an account with a certain bank or switch banks entirely. From there, you can easily compare the products and services that the banks offer and determine which bank would be best suitable for you.